PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709974

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709974

Global Advanced Inertial Sensors Testers Market 2025-2035

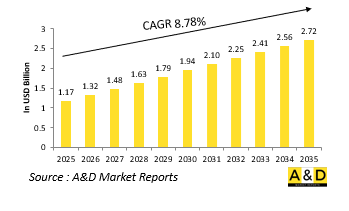

The Global Advanced Inertial Sensors Testers market is estimated at USD 1.17 billion in 2025, projected to grow to USD 2.72 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.78% over the forecast period 2025-2035.

Introduction to Advanced Inertial Sensors Testers Market:

The global defense advanced inertial sensors testers market operates at the intersection of precision engineering and mission-critical validation. Inertial sensors, including gyroscopes and accelerometers, are core components in a wide array of military systems such as guided munitions, unmanned platforms, submarines, and tactical aircraft. These sensors enable autonomous navigation and targeting without reliance on external signals, making them indispensable in contested environments. As the sophistication of inertial systems increases, so too does the need for specialized testing solutions that can verify their accuracy, reliability, and resilience. Advanced testers are designed to evaluate these sensors under a range of simulated operational conditions, ensuring that they perform consistently in the face of vibration, extreme temperature, shock, and high-G maneuvers. Within defense applications, even the smallest calibration errors can lead to critical mission failures, making dependable and repeatable test processes essential. These testers not only support initial validation but also enable ongoing performance monitoring, contributing to long-term system integrity and mission assurance. With modern warfare relying heavily on sensor fusion and autonomous operation, the role of advanced inertial sensor testers has become fundamental to maintaining the edge in both strategic defense systems and tactical operations across global armed forces.

Technology Impact in Advanced Inertial Sensors Testers Market:

Technological innovation is redefining the performance envelope of test systems used for advanced inertial sensors in defense. These sensors now demand evaluation frameworks capable of matching their high sensitivity and precision with equal rigor and control. Advanced testing systems leverage high-resolution motion simulators, micro-level thermal chambers, and electromagnetic shielding to recreate challenging operational environments. Real-time data acquisition and automated calibration algorithms reduce test cycles while improving the reliability of results. Customizable software platforms offer tailored test protocols suited to specific sensor architectures, including fiber-optic gyroscopes, ring laser gyroscopes, and MEMS-based accelerometers. Integration with digital feedback systems ensures that anomalies can be traced and corrected instantly, improving quality assurance. Moreover, emerging technologies like machine learning and embedded diagnostics are enhancing fault prediction, allowing proactive maintenance and reducing system downtime. Portable test units are being developed for field deployment, enabling validation outside traditional lab environments. These technological capabilities are not only increasing test accuracy but also aligning with broader defense goals such as modularity, speed of deployment, and interoperability. As militaries demand more agile and autonomous systems, the technology behind sensor testing must keep pace, positioning it as a strategic enabler of innovation across platforms and domains.

Key Drivers in Advanced Inertial Sensors Testers market:

Several factors are fueling the demand for advanced inertial sensors testers in the defense sector, each rooted in the growing complexity of modern military systems and the strategic shift toward precision warfare. With an increasing emphasis on autonomous operations, sensors must function flawlessly under unpredictable and hostile conditions. This elevates the importance of highly specialized test equipment that can verify sensor performance under both static and dynamic stressors. The rise of next-generation weapons systems, including hypersonic glide vehicles and long-range precision missiles, further amplifies the need for extremely accurate inertial data, which in turn demands rigorous validation tools. As electronic warfare and signal denial environments become more prevalent, reliance on internally referenced navigation increases, reinforcing the role of inertial systems-and by extension, their testers. Additionally, the defense sector is under continuous pressure to reduce operational risk, lower sustainment costs, and extend the life of key systems, all of which depend on early detection of faults and consistent maintenance. The push for real-time performance metrics, seamless integration into automated maintenance workflows, and support for multi-sensor architectures are also shaping procurement decisions. These drivers reflect a broader demand for intelligent, reliable, and forward-compatible test solutions that can evolve alongside emerging defense capabilities.

Regional Trends in Advanced Inertial Sensors Testers Market:

Regional dynamics in the defense advanced inertial sensors testers market are heavily influenced by defense strategies, threat landscapes, and indigenous technological development. North America leads the adoption of cutting-edge test solutions, driven by its focus on full-spectrum readiness and innovation in military hardware. The presence of major defense primes and research labs supports rapid development and deployment of high-performance testers, often integrated with sophisticated simulation environments. In Europe, strategic autonomy and interoperability among allied forces are top priorities, prompting investments in scalable and standardized test equipment that can support multinational operations. Several countries in this region are also bolstering their space and missile defense capabilities, which adds to the demand for precision sensor testing. The Asia-Pacific region continues to experience rapid growth, propelled by escalating regional tensions, expanding naval and air forces, and national programs aimed at developing indigenous navigation technologies. Countries like Japan, India, and South Korea are building robust domestic test infrastructure to support defense modernization. In the Middle East, the demand is tied to enhancing high-tech deterrent capabilities and sustaining imported platforms, leading to investments in dependable, locally operable test systems. These varied regional needs are shaping a diverse and dynamic market landscape with tailored solutions emerging across different geographies.

Key Defense Advanced Inertial Sensors Testers Program:

General Atomics and Israel's Rafael Advanced Defense Systems have announced a collaboration to develop a long-range precision-guided missile for the U.S. market. Named Bullseye, the missile is designed for launch from land, sea, and air platforms, and is intended to deliver powerful strike capabilities against high-value targets at a competitive cost. The new system was officially introduced during the Sea-Air-Space 2025 conference in Maryland. Bullseye appears to be based on Rafael's Ice Breaker missile, which has a range of 300 kilometers (186 miles). However, according to General Atomics, the new missile will feature enhanced flexibility, supporting multiple warhead types and propulsion configurations, as detailed on the company's product page.

Table of Contents

Global Advanced Inertial Sensors Testers - Table of Contents

Global Advanced Inertial Sensors Testers Report Definition

Global Advanced Inertial Sensors Testers Segmentation

By Component

By Technology

By Application

By Region

Global Advanced Inertial Sensors Testers Analysis for next 10 Years

The 10-year Global Advanced Inertial Sensors Testers analysis would give a detailed overview of Global Advanced Inertial Sensors Testers growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Advanced Inertial Sensors Testers

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Advanced Inertial Sensors Testers Forecast

The 10-year Global Advanced Inertial Sensors Testers forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Advanced Inertial Sensors Testers Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Advanced Inertial Sensors Testers

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Advanced Inertial Sensors Testers

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Advanced Inertial Sensors Testers Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Component, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Application, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Technology, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Component, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Application, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Technology, 2022-2032

List of Figures

- Figure 1: Global Advanced Inertial Sensors Tester Forecast, 2022-2032

- Figure 2: Global Advanced Inertial Sensors Tester Forecast, By Region, 2022-2032

- Figure 3: Global Advanced Inertial Sensors Tester Forecast, By Component, 2022-2032

- Figure 4: Global Advanced Inertial Sensors Tester Forecast, By Application, 2022-2032

- Figure 5: Global Advanced Inertial Sensors Tester Forecast, By Technology, 2022-2032

- Figure 6: North America, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 7: Europe, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 8: Middle East, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 9: APAC, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 10: South America, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 11: United States, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 12: United States, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 13: Canada, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 14: Canada, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 15: Italy, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 16: Italy, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 17: France, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 18: France, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 19: Germany, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 20: Germany, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 21: Netherlands, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 23: Belgium, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 24: Belgium, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 25: Spain, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 26: Spain, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 27: Sweden, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 28: Sweden, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 29: Brazil, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 30: Brazil, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 31: Australia, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 32: Australia, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 33: India, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 34: India, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 35: China, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 36: China, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 39: South Korea, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 40: South Korea, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 41: Japan, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 42: Japan, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 43: Malaysia, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 45: Singapore, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 46: Singapore, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Advanced Inertial Sensors Tester, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Advanced Inertial Sensors Tester, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Advanced Inertial Sensors Tester, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Advanced Inertial Sensors Tester, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Advanced Inertial Sensors Tester, By Component (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Advanced Inertial Sensors Tester, By Component (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Advanced Inertial Sensors Tester, By Application (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Advanced Inertial Sensors Tester, By Application (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Advanced Inertial Sensors Tester, By Technology (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Advanced Inertial Sensors Tester, By Technology (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Advanced Inertial Sensors Tester, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Advanced Inertial Sensors Tester, Global Market, 2022-2032

- Figure 59: Scenario 1, Advanced Inertial Sensors Tester, Total Market, 2022-2032

- Figure 60: Scenario 1, Advanced Inertial Sensors Tester, By Region, 2022-2032

- Figure 61: Scenario 1, Advanced Inertial Sensors Tester, By Component, 2022-2032

- Figure 62: Scenario 1, Advanced Inertial Sensors Tester, By Application, 2022-2032

- Figure 63: Scenario 1, Advanced Inertial Sensors Tester, By Technology, 2022-2032

- Figure 64: Scenario 2, Advanced Inertial Sensors Tester, Total Market, 2022-2032

- Figure 65: Scenario 2, Advanced Inertial Sensors Tester, By Region, 2022-2032

- Figure 66: Scenario 2, Advanced Inertial Sensors Tester, By Component, 2022-2032

- Figure 67: Scenario 2, Advanced Inertial Sensors Tester, By Application, 2022-2032

- Figure 68: Scenario 2, Advanced Inertial Sensors Tester, By Technology, 2022-2032

- Figure 69: Company Benchmark, Advanced Inertial Sensors Tester, 2022-2032