PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709972

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709972

Global INS Automated Test Equipment Market 2025-2035

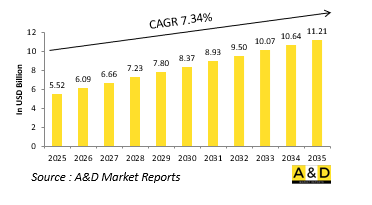

The global INS Automated Test Equipment market is estimated at USD 5.52 billion in 2025, projected to grow o USD 11.21 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 7.34% over the forecast period 2025-2035.

Introduction to Global INS Automated Test Equipment market:

The global defense INS automated test equipment market is a crucial segment supporting the development, calibration, and maintenance of inertial navigation systems used in military platforms. These systems provide accurate navigation and positioning without reliance on external signals, making them essential in contested or GPS-denied environments. As defense platforms such as fighter jets, submarines, guided missiles, and unmanned aerial systems become more advanced, the demand for precise, resilient navigation systems continues to grow. Automated test equipment tailored for defense-grade INS ensures that these complex systems function reliably under extreme conditions, including rapid acceleration, vibration, and thermal variation. The equipment plays a vital role in identifying system faults, validating performance standards, and maintaining combat readiness. Furthermore, defense procurement strategies increasingly emphasize lifecycle cost savings, efficiency, and system longevity, all of which are supported by automated testing. Given the critical nature of defense operations, nations across the globe are investing heavily in test capabilities that can handle high-throughput, secure, and highly accurate validation. The defense-specific requirements also influence the architecture and compliance standards of automated test equipment, driving innovation to meet mission-critical expectations. As militaries modernize their fleets, the INS test equipment market remains an indispensable enabler of operational effectiveness and technological superiority.

Technology Impact in INS Automated Test Equipment Market:

Technological advancement is transforming the defense INS automated test equipment landscape, enabling greater accuracy, reliability, and operational flexibility. Sophisticated platforms now require test systems capable of replicating real-world mission conditions with a high degree of precision. Advanced simulation capabilities, including dynamic motion profiling and environmental replication, allow test equipment to mimic the stressors encountered in combat or harsh operational scenarios. Artificial intelligence is beginning to support adaptive testing algorithms that can detect anomalies and optimize calibration in real time, significantly improving fault detection and reducing human intervention. Secure data protocols, encryption, and cybersecurity layers are being integrated into test platforms to ensure information integrity and confidentiality during sensitive military evaluations. Modular, software-defined test systems are becoming standard, offering scalability to test multiple configurations of navigation systems across air, land, and sea platforms. In addition, the integration of digital twins enables predictive diagnostics and lifecycle management, offering a virtual representation of INS performance over time. These advancements are not only enhancing the capability of test systems but also reducing testing time, increasing mission assurance, and supporting rapid deployment of new systems. Overall, technology is driving the evolution of defense INS test solutions into more intelligent, robust, and mission-aligned tools for modern military needs.

Key Drivers in INS Automated Test Equipment Market:

Several critical factors are driving the growth of the defense INS automated test equipment market. One major driver is the increased complexity and miniaturization of modern inertial navigation systems, which demand highly specialized testing solutions to verify performance under mission-specific parameters. As military operations rely more heavily on precision-guided munitions, autonomous vehicles, and multi-domain integration, the need for accurate, dependable navigation systems is paramount. These systems must operate flawlessly in environments where GPS may be degraded or denied, making rigorous automated testing essential for mission success. Another key driver is the global trend of defense modernization, with militaries replacing or upgrading aging platforms with advanced systems that include next-generation INS technologies. Governments are placing greater emphasis on rapid deployment and lifecycle sustainment, both of which require automated and reliable test processes. Additionally, there is growing demand for reduced system downtime and faster diagnostics, particularly in high-readiness or combat situations. Compliance with stringent military standards and interoperability across allied forces further amplifies the need for standardized, high-fidelity testing equipment. Collectively, these drivers are shaping a defense ecosystem that prioritizes automation, efficiency, and resilience, making INS automated test equipment an essential component of future-ready military infrastructure.

Regional Trends in INS Automated Test Equipment Market:

The defense INS automated test equipment market reflects distinct regional priorities and capabilities shaped by geopolitical considerations, defense budgets, and technological infrastructure. In North America, especially in the United States, the market is propelled by sustained investment in defense modernization, advanced aerospace programs, and unmanned systems. The presence of leading defense contractors and government-funded research accelerates innovation in both INS and associated test equipment. Europe continues to maintain a strong presence, with countries emphasizing NATO interoperability, precision defense technologies, and joint programs that necessitate robust testing solutions. Nations such as France, Germany, and the United Kingdom are also investing in indigenous development of high-precision INS and supporting test frameworks. In the Asia-Pacific region, growing regional tensions and a push for military self-reliance are driving countries like China, India, South Korea, and Japan to strengthen their defense capabilities. These efforts include expanding their capacity for INS development and ensuring rigorous testing infrastructure is in place. The Middle East, with its emphasis on high-tech military acquisitions and regional security preparedness, is also contributing to demand for sophisticated test solutions. While Latin America and Africa are emerging at a slower pace, they are increasingly exploring advanced defense technologies, including the adoption of automated INS testing platforms as part of broader modernization initiatives.

Key INS Automated Test Equipment Program:

General Atomics has partnered with Israel's Rafael Advanced Defense Systems to develop a long-range precision-guided missile tailored for the U.S. market. The new weapon system was unveiled during the Sea-Air-Space 2025 conference in Maryland. Named the Bullseye missile, the system appears to be based on Rafael's Ice Breaker platform, which boasts a range of 300 kilometers (186 miles). However, unlike the original Ice Breaker, Bullseye will feature modular capabilities, allowing it to accommodate different warheads and propulsion systems, according to information shared on General Atomics' product page.

Table of Contents

Global INS Automated Test Equipment in aerospace and Defense - Table of Contents

Global INS Automated Test Equipment in aerospace and Defense Report Definition

Global INS Automated Test Equipment in aerospace and Defense Segmentation

By Type

By End User

By Application

By Region

Global INS Automated Test Equipment in aerospace and Defense Analysis for next 10 Years

The 10-year Global INS Automated Test Equipment in aerospace and Defense analysis would give a detailed overview of Global INS Automated Test Equipment in aerospace and Defense growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global INS Automated Test Equipment in aerospace and Defense

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global INS Automated Test Equipment in aerospace and Defense Forecast

The 10-year Global INS Automated Test Equipment in aerospace and Defense forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global INS Automated Test Equipment in aerospace and Defense Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global INS Automated Test Equipment in aerospace and Defense

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global INS Automated Test Equipment in aerospace and Defense

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global INS Automated Test Equipment in aerospace and Defense Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By End User, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Application, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Type, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By End User, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Application, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Type, 2022-2032

List of Figures

- Figure 1: Global Defense INS Automated Test Equipment Forecast, 2022-2032

- Figure 2: Global Defense INS Automated Test Equipment Forecast, By Region, 2022-2032

- Figure 3: Global Defense INS Automated Test Equipment Forecast, By End User, 2022-2032

- Figure 4: Global Defense INS Automated Test Equipment Forecast, By Application, 2022-2032

- Figure 5: Global Defense INS Automated Test Equipment Forecast, By Type, 2022-2032

- Figure 6: North America, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 7: Europe, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 8: Middle East, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 9: APAC, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 10: South America, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 11: United States, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 12: United States, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 13: Canada, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 14: Canada, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 15: Italy, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 16: Italy, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 17: France, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 18: France, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 19: Germany, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 20: Germany, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 21: Netherlands, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 23: Belgium, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 24: Belgium, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 25: Spain, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 26: Spain, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 27: Sweden, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 28: Sweden, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 29: Brazil, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 30: Brazil, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 31: Australia, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 32: Australia, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 33: India, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 34: India, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 35: China, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 36: China, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 39: South Korea, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 40: South Korea, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 41: Japan, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 42: Japan, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 43: Malaysia, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 45: Singapore, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 46: Singapore, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Defense INS Automated Test Equipment, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Defense INS Automated Test Equipment, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Defense INS Automated Test Equipment, By End User (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Defense INS Automated Test Equipment, By End User (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Defense INS Automated Test Equipment, By Application (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Defense INS Automated Test Equipment, By Application (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Defense INS Automated Test Equipment, By Type (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Defense INS Automated Test Equipment, By Type (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Defense INS Automated Test Equipment, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Defense INS Automated Test Equipment, Global Market, 2022-2032

- Figure 59: Scenario 1, Defense INS Automated Test Equipment, Total Market, 2022-2032

- Figure 60: Scenario 1, Defense INS Automated Test Equipment, By Region, 2022-2032

- Figure 61: Scenario 1, Defense INS Automated Test Equipment, By End User, 2022-2032

- Figure 62: Scenario 1, Defense INS Automated Test Equipment, By Application, 2022-2032

- Figure 63: Scenario 1, Defense INS Automated Test Equipment, By Type, 2022-2032

- Figure 64: Scenario 2, Defense INS Automated Test Equipment, Total Market, 2022-2032

- Figure 65: Scenario 2, Defense INS Automated Test Equipment, By Region, 2022-2032

- Figure 66: Scenario 2, Defense INS Automated Test Equipment, By End User, 2022-2032

- Figure 67: Scenario 2, Defense INS Automated Test Equipment, By Application, 2022-2032

- Figure 68: Scenario 2, Defense INS Automated Test Equipment, By Type, 2022-2032

- Figure 69: Company Benchmark, Defense INS Automated Test Equipment, 2022-2032