PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1706591

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1706591

Global Underwater Loitering Reconnaissance System 2025-2035

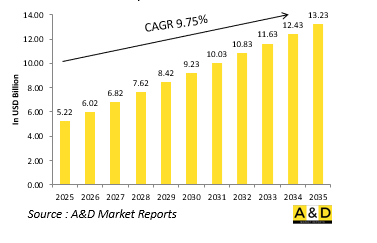

The Global Underwater Loitering Reconnaissance market is estimated at USD 5.22 billion in 2025, projected to grow to USD 13.23 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 9.75% over the forecast period 2025-2035.

Introduction to Underwater Loitering Reconnaissance System Market

Underwater Loitering Reconnaissance Systems (ULRS) represent a sophisticated evolution in subsea military surveillance and intelligence gathering. These systems are typically autonomous or semi-autonomous underwater vehicles (UUVs) or drones designed to operate stealthily beneath the surface for extended durations. They "loiter" in specific areas of interest, gathering acoustic, thermal, and visual data, often in contested or sensitive maritime zones. Unlike conventional submarines or active patrol vessels, ULRS are smaller, quieter, and more expendable, making them ideal for persistent reconnaissance missions without escalating tensions or revealing national assets. These systems are becoming increasingly vital for modern naval operations, particularly in regions where undersea dominance is critical for strategic advantage. Whether it's tracking enemy submarines, monitoring underwater infrastructure like pipelines and cables, or surveying sea bed's for mines and anomalies, ULRS provide a high-endurance, low-profile surveillance capability. The need for real-time, underwater situational awareness is rapidly growing, and these loitering platforms fill a crucial gap between traditional sonar networks and large manned submarines. With rising geopolitical tensions in littoral waters, congested sea lanes, and contested maritime zones, military forces are turning to ULRS as an indispensable part of next-generation underwater warfare and intelligence.

Technology Impact in Underwater Loitering Reconnaissance System Market:

Technological advancements have radically improved the functionality and strategic utility of ULRS. A key enabler is the development of compact, high-efficiency power systems, including advanced lithium-ion and aluminum-seawater batteries that allow these platforms to operate for days or even weeks underwater without resurfacing. Some emerging models even harness ocean currents or thermal gradients for energy harvesting, enhancing endurance without sacrificing stealth.

Sensor payloads are another area of major progress. Modern ULRS are equipped with passive and active sonar arrays, hydrophones, side-scan sonar, magnetic anomaly detectors, and high-definition cameras. These sensors, coupled with onboard data fusion and edge computing capabilities, enable the vehicle to identify threats, map terrain, and detect irregular activities autonomously without needing to transmit data until mission completion or surfacing. This minimizes the risk of detection via electronic signature.

Artificial Intelligence (AI) is also playing a transformative role. AI algorithms help in onboard decision-making, enabling these platforms to autonomously patrol pre-defined grids, avoid obstacles, recognize patterns such as vessel traffic or submerged objects, and prioritize data for extraction. AI also aids in swarm behavior, allowing multiple ULRS to coordinate missions in distributed fashion without constant remote control.

Stealth and low-observability designs have become a design priority. Manufacturers are using materials that reduce acoustic signature and radar cross-section when surfacing briefly. Some systems mimic marine life behaviors or fish-like propulsion to blend in with natural environments, complicating enemy detection efforts. Lastly, developments in underwater communications-such as acoustic modems and low-frequency data bursts-are enhancing the ability to update mission parameters or receive situational reports in near real time, even in GPS-denied environments. While bandwidth is limited underwater, ongoing research in quantum and laser-based submarine communication could soon further transform this capability.

Key Drivers in Underwater Loitering Reconnaissance System Market:

The increasing demand for ULRS is driven by several converging strategic, operational, and environmental factors.

Rising undersea threats are a major catalyst. With adversaries deploying stealthier submarines and investing in seabed warfare capabilities, the ability to maintain persistent, low-visibility surveillance has become critical. Loitering systems offer a way to detect incursions or monitor critical zones without risking expensive manned platforms. Maritime infrastructure protection is another significant driver. Subsea cables, oil and gas pipelines, offshore platforms, and even undersea data hubs have become vital national assets and potential targets. ULRS are uniquely suited to patrol these installations, identify anomalies, and deter sabotage or unauthorized activities without exposing surface assets.

Asymmetric capabilities offered by ULRS are also drawing interest. For navies with limited budgets or smaller blue-water presence, these systems provide a cost-effective solution to expand underwater ISR (intelligence, surveillance, reconnaissance) reach. Even smaller nations can now field credible underwater capabilities with less logistical burden than traditional submersible fleets. Anti-access/area denial (A2/AD) environments, such as the South China Sea or Baltic Sea, pose operational challenges to traditional patrol craft. In these contested waters, stealthy, loitering UUVs offer strategic flexibility by performing deep reconnaissance behind adversary lines or near disputed waters without triggering escalatory responses. Joint force integration is also driving adoption. ULRS can feed real-time data into larger naval battle networks, helping integrate submarine, surface, and air operations. When connected with satellite links, command centers, or patrol vessels, they help build a unified maritime operational picture. Environmental monitoring and dual-use capability contribute as well. ULRS platforms can gather data on tides, currents, salinity, and seabed structures-critical for both military and scientific missions. This dual-use nature opens the door for peacetime deployments, disaster response, and support of marine environmental protection efforts.

Regional Trends in Underwater Loitering Reconnaissance System Market:

The U.S. Navy remains at the forefront of ULRS development, through initiatives like the Extra-Large Unmanned Undersea Vehicle (XLUUV) and programs within the Undersea Warfare Division. These systems are integrated into broader undersea networks including sonar arrays and manned submarines. The U.S. is also investing in swarming ULRS and AI-driven autonomous behavior for ISR and mine countermeasure missions. Canada is enhancing its Arctic maritime surveillance through similar loitering systems adapted for cold water endurance.

European navies are increasingly focusing on underwater dominance in response to both regional tensions and the need to protect vast undersea infrastructure. The UK's Royal Navy and France's Marine Nationale are collaborating with tech firms to develop modular ULRS platforms for persistent surveillance and anti-submarine warfare. Nordic countries like Norway and Sweden, concerned with Russian undersea movements in the Baltic, are deploying UUVs that blend reconnaissance and tactical flexibility. Germany is investing in seabed warfare capabilities, incorporating loitering UUVs into hybrid systems that map and patrol the ocean floor.

China is significantly advancing its undersea loitering technologies under the umbrella of "intelligentized" warfare. The People's Liberation Army Navy (PLAN) is developing UUVs capable of long-endurance surveillance near key maritime chokepoints and in disputed zones. Japan and South Korea are investing in ULRS to strengthen their anti-submarine warfare (ASW) capabilities, especially in light of North Korea's undersea ambitions. Australia is incorporating loitering UUVs into its maritime surveillance framework under the SEA 1000 and SEA 1905 programs, designed to boost regional naval intelligence.

Key Underwater Loitering Reconnaissance System Program:

Exail has announced that the French Navy has placed an order for an autonomous underwater vehicle (AUV) designed to monitor critical infrastructure at depths reaching 6,000 meters. The new AUV will be based on Exail's Ulyx platform, developed in collaboration with Ifremer, France's national institute for ocean science and technology. It will be primarily deployed for seabed reconnaissance missions, focusing on safeguarding vital underwater assets such as submarine cables, many of which are located at extreme depths.

Table of Contents

Underwater Loitering Reconnaissance System Market Report Definition

Underwater Loitering Reconnaissance System Market Segmentation

By Region

By Size

By Propulsion

Underwater Loitering Reconnaissance System Market Analysis for next 10 Years

The 10-year underwater loitering reconnaissance system market analysis would give a detailed overview of missile and smart kits guidance market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Underwater Loitering Reconnaissance System Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Underwater Loitering Reconnaissance System Market Forecast

The 10-year underwater loitering reconnaissance system market forecast of this market is covered in detailed across the segments which are mentioned above.

Underwater Loitering Reconnaissance System Market Trends & Forecast

The regional underwater loitering reconnaissance system market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Underwater Loitering Reconnaissance System Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Underwater Loitering Reconnaissance System Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Underwater Loitering Reconnaissance System Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Size, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Propulsion, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Size, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Propulsion, 2025-2035

List of Figures

- Figure 1: Global Underwater Loitering Reconnaissance System Market Forecast, 2025-2035

- Figure 2: Global Underwater Loitering Reconnaissance System Market Forecast, By Region, 2025-2035

- Figure 3: Global Underwater Loitering Reconnaissance System Market Forecast, By Size, 2025-2035

- Figure 4: Global Underwater Loitering Reconnaissance System Market Forecast, By Propulsion, 2025-2035

- Figure 5: North America, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 6: Europe, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 8: APAC, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 9: South America, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 10: United States, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 11: United States, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 12: Canada, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 14: Italy, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 16: France, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 17: France, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 18: Germany, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 24: Spain, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 30: Australia, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 32: India, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 33: India, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 34: China, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 35: China, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 40: Japan, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Underwater Loitering Reconnaissance System Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Underwater Loitering Reconnaissance System Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Underwater Loitering Reconnaissance System Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Underwater Loitering Reconnaissance System Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Underwater Loitering Reconnaissance System Market, By Size (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Underwater Loitering Reconnaissance System Market, By Size (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Underwater Loitering Reconnaissance System Market, By Propulsion (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Underwater Loitering Reconnaissance System Market, By Propulsion (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Underwater Loitering Reconnaissance System Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Underwater Loitering Reconnaissance System Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Underwater Loitering Reconnaissance System Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Underwater Loitering Reconnaissance System Market, By Region, 2025-2035

- Figure 58: Scenario 1, Underwater Loitering Reconnaissance System Market, By Size, 2025-2035

- Figure 59: Scenario 1, Underwater Loitering Reconnaissance System Market, By Propulsion, 2025-2035

- Figure 60: Scenario 2, Underwater Loitering Reconnaissance System Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Underwater Loitering Reconnaissance System Market, By Region, 2025-2035

- Figure 62: Scenario 2, Underwater Loitering Reconnaissance System Market, By Size, 2025-2035

- Figure 63: Scenario 2, Underwater Loitering Reconnaissance System Market, By Propulsion, 2025-2035

- Figure 64: Company Benchmark, Underwater Loitering Reconnaissance System Market, 2025-2035