PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1706585

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1706585

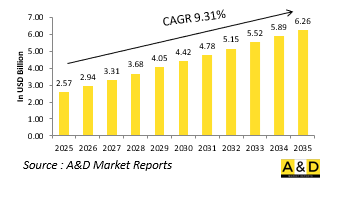

Global Small UAV Market 2025-2035

The Global Small UAV market is estimated at USD 2.57 billion in 2025, projected to grow to USD 6.26 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 9.31% over the forecast period 2025-2035.

Introduction to Small UAV Market:

Small Unmanned Aerial Vehicles (UAVs), often referred to as mini or tactical drones, have become integral to modern military operations across the globe. Defined typically as UAVs with a wingspan under 3 meters and weighing less than 150 kg, these platforms are designed for close-range reconnaissance, surveillance, target acquisition, communication relay, and even light combat roles. Unlike larger UAVs used for strategic missions, small military UAVs excel in tactical environments where speed, stealth, and ease of deployment are critical. The global military landscape is increasingly leaning on these compact, versatile platforms for frontline intelligence and rapid situational awareness. Their affordability, ease of operation, and adaptability make them valuable tools for both conventional forces and special operations units. Small UAVs can be launched by hand, catapult, or vertical take-off methods, making them ideal for missions in rugged terrain, dense urban zones, or remote battlefields where larger systems cannot operate efficiently. As the nature of warfare shifts toward mobility, urban engagement, and multi-domain operations, small UAVs are emerging as indispensable assets across land, sea, and air-based units.

Technology Impact in Small UAV Market:

Technological advancements have significantly elevated the capability and utility of small military UAVs. The most transformative impact has come from miniaturization of sensors and payloads. Electro-optical and infrared cameras, synthetic aperture radars, electronic warfare modules, and chemical sensors are now small enough to be carried by mini-UAVs without sacrificing performance. This allows troops to gather actionable intelligence in real time without revealing their position. Autonomy and artificial intelligence are also redefining how small UAVs are employed. Advanced navigation algorithms allow for GPS-denied operations, crucial in electronically contested environments. AI-enabled object recognition helps UAVs distinguish between civilians, vehicles, or weapons systems, enabling real-time threat identification. Furthermore, swarm algorithms are being developed to allow groups of small UAVs to coordinate independently, overwhelming enemy defenses and enabling large-area coverage without centralized control.

Battery and propulsion improvements are enhancing endurance and operational range. The adoption of high-density lithium-sulfur batteries, hybrid propulsion systems, and even solar-assisted designs have extended flight times well beyond earlier limits. These innovations make it possible to maintain persistent surveillance or support prolonged missions without frequent redeployment. Secure communications and data encryption have become critical due to the growing risk of electronic warfare. Many modern military small UAVs are now equipped with anti-jamming and frequency-hopping capabilities to ensure resilience in contested electromagnetic environments. In parallel, onboard data processing reduces the need to transmit large volumes of data, lowering the risk of interception. Finally, the integration with soldier systems-such as heads-up displays or tactical command networks-enhances decision-making and reaction speed. Troops can now launch and control UAVs from wrist-mounted devices or augmented reality interfaces, providing real-time feedback directly to units in motion, making these drones more like battlefield teammates than remote tools.

Key Drivers in Small UAV Market:

Several key factors are propelling the demand and deployment of small UAVs in military operations worldwide. Chief among them is the changing nature of warfare, which increasingly emphasizes rapid maneuvering, decentralized operations, and asymmetric threats. Small UAVs offer a tactical edge in detecting hidden threats, mapping unknown terrain, and guiding precision strikes in environments where speed and stealth are paramount. Budget efficiency and cost-effectiveness are strong drivers as well. Compared to larger UAVs or manned aircraft, small drones are significantly cheaper to procure, maintain, and operate. This makes them accessible not only to major military powers but also to developing countries or units with limited resources. Their reusability and low-risk deployment further strengthen their appeal in contested regions or surveillance missions.

Border security and counterinsurgency operations are also influencing adoption. Nations dealing with smuggling, terrorism, and cross-border incursions require persistent surveillance without escalating conflict. Small UAVs serve this role effectively, offering real-time monitoring capabilities while minimizing human risk. They can be equipped with non-lethal payloads, such as acoustic devices or illumination flares, making them useful for deterrence without engagement. Another crucial factor is increased investment in network-centric warfare capabilities. Small UAVs are being integrated into broader combat systems as remote sensors or forward observers. Their ability to transmit data directly to artillery units, airstrike coordinators, or cyber warfare teams makes them vital nodes in the real-time digital battlefield. The emphasis on multi-domain operations-from land and sea to cyber and space-is accelerating the need for flexible UAV platforms that can adapt and interface with various command systems. The rise of peer and near-peer threats is pushing militaries to improve their tactical ISR (intelligence, surveillance, reconnaissance) capabilities at the lowest levels. In conflicts where air dominance is contested or denied, small UAVs provide critical local eyes and ears that do not rely on traditional air support or satellite assets, giving ground troops the situational awareness needed to survive and win.

Regional Trends in Small UAV Market:

The global adoption of small military UAVs varies by region, influenced by geopolitical priorities, military doctrine, and technological capacity. North America, particularly the United States, leads in the research, development, and operational use of military small UAVs. Platforms like the RQ-11 Raven, Puma, and Black Hornet are extensively used across various branches of the U.S. military. Integration with special forces and conventional units alike has made these systems a staple in tactical ISR and mission support. The U.S. is also at the forefront of swarm technology and AI-driven UAVs through DARPA and other military research initiatives.

Europe is witnessing steady growth in adoption, especially among NATO members seeking enhanced ISR capabilities and battlefield networking. Countries like the UK, France, and Germany are investing in indigenous UAV programs to reduce dependence on U.S. platforms. France's NX70 and Germany's Mikado series are examples of localized efforts to develop modular, soldier-portable UAVs. Additionally, the European Defence Agency has emphasized interoperability standards for drones to support joint missions. Asia-Pacific presents a highly dynamic landscape. China has rapidly expanded its small UAV fleet for both domestic use and export. Chinese manufacturers such as DJI and AVIC are supplying the People's Liberation Army with a wide variety of drones, including swarm-capable units and backpack-portable systems for frontline troops. India is also making significant progress with its DRDO-developed UAVs and increased procurement of small drones for counter-insurgency and border patrol roles. Countries like South Korea, Japan, and Australia are prioritizing drone integration into their defense doctrines to counter regional threats and bolster coastal defense.

Key Defense Small UAV Program:

ideaForge Technology Limited, a global leader in drone innovation, proudly announces that its SWITCH MINI UAV has become the first and only small unmanned aerial vehicle to receive the prestigious "Fit for Indian Military Use" certification. This recognition highlights the UAV's exceptional performance, quality, and reliability, as well as its ability to meet the stringent operational standards of the Indian armed forces. The certification, awarded following rigorous evaluations conducted by the Directorate General of Quality Assurance (DGQA), marks a significant milestone for the Indian drone industry. It also reinforces ideaForge's standing as a global frontrunner in dual-use drone technologies designed for both defense and civilian applications.

The U.S. Army has awarded a contract to Utah-based drone manufacturer Teal Drones to supply thousands of its Black Widow unmanned aerial vehicles, following a successful test and evaluation process. Teal Drones, headquartered in Salt Lake City, produces the UAVs locally and operates as a subsidiary of Red Cat Holdings Inc., which is based in Puerto Rico.

Table of Contents

Small UAV Market Report Definition

Small UAV Market Segmentation

By Region

By Type

By Application

Small UAV Market Analysis for next 10 Years

The 10-year small UAV market analysis would give a detailed overview of small UAV market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Small UAV Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Small UAV Market Forecast

The 10-year small UAV market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Small UAV Market Trends & Forecast

The regional small UAV market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Small UAV Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Small UAV Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Small UAV Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Product Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Product Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Small UAV Market Forecast, 2025-2035

- Figure 2: Global Small UAV Market Forecast, By Region, 2025-2035

- Figure 3: Global Small UAV Market Forecast, By Product Type, 2025-2035

- Figure 4: Global Small UAV Market Forecast, By Application, 2025-2035

- Figure 5: North America, Small UAV Market, Market Forecast, 2025-2035

- Figure 6: Europe, Small UAV Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Small UAV Market, Market Forecast, 2025-2035

- Figure 8: APAC, Small UAV Market, Market Forecast, 2025-2035

- Figure 9: South America, Small UAV Market, Market Forecast, 2025-2035

- Figure 10: United States, Small UAV Market, Technology Maturation, 2025-2035

- Figure 11: United States, Small UAV Market, Market Forecast, 2025-2035

- Figure 12: Canada, Small UAV Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Small UAV Market, Market Forecast, 2025-2035

- Figure 14: Italy, Small UAV Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Small UAV Market, Market Forecast, 2025-2035

- Figure 16: France, Small UAV Market, Technology Maturation, 2025-2035

- Figure 17: France, Small UAV Market, Market Forecast, 2025-2035

- Figure 18: Germany, Small UAV Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Small UAV Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Small UAV Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Small UAV Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Small UAV Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Small UAV Market, Market Forecast, 2025-2035

- Figure 24: Spain, Small UAV Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Small UAV Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Small UAV Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Small UAV Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Small UAV Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Small UAV Market, Market Forecast, 2025-2035

- Figure 30: Australia, Small UAV Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Small UAV Market, Market Forecast, 2025-2035

- Figure 32: India, Small UAV Market, Technology Maturation, 2025-2035

- Figure 33: India, Small UAV Market, Market Forecast, 2025-2035

- Figure 34: China, Small UAV Market, Technology Maturation, 2025-2035

- Figure 35: China, Small UAV Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Small UAV Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Small UAV Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Small UAV Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Small UAV Market, Market Forecast, 2025-2035

- Figure 40: Japan, Small UAV Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Small UAV Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Small UAV Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Small UAV Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Small UAV Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Small UAV Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Small UAV Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Small UAV Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Small UAV Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Small UAV Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Small UAV Market, By Product Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Small UAV Market, By Product Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Small UAV Market, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Small UAV Market, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Small UAV Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Small UAV Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Small UAV Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Small UAV Market, By Region, 2025-2035

- Figure 58: Scenario 1, Small UAV Market, By Product Type, 2025-2035

- Figure 59: Scenario 1, Small UAV Market, By Application, 2025-2035

- Figure 60: Scenario 2, Small UAV Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Small UAV Market, By Region, 2025-2035

- Figure 62: Scenario 2, Small UAV Market, By Product Type, 2025-2035

- Figure 63: Scenario 2, Small UAV Market, By Application, 2025-2035

- Figure 64: Company Benchmark, Small UAV Market, 2025-2035