PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1680167

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1680167

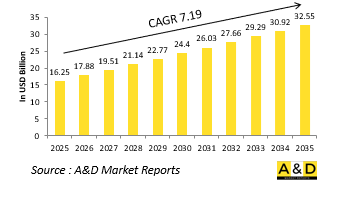

Global Defense Turbojet Engine Market 2025-2035

The Global defense turbojet engine market is estimated at USD 16.25 billion in 2025, projected to grow to USD 32.55 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 7.19% over the forecast period 2025-2035.

Introduction to Defense Turbojet Engine Market:

The global defense turbojet engine market remains a vital segment of military aviation, powering high-speed aircraft designed for combat, reconnaissance, and strategic defense missions. Turbojet engines, known for their ability to deliver high thrust at supersonic speeds, have long been a cornerstone of fighter jets, bombers, and unmanned aerial systems (UAS). While modern combat aircraft have largely transitioned to turbofan engines for greater fuel efficiency and range, turbojets still play a significant role in specific defense applications, including high-speed interceptor aircraft, cruise missiles, and target drones. As global military forces continue to modernize their air fleets, the demand for advanced turbojet engines remains steady, particularly for next-generation missile systems and supersonic UAVs. The market is witnessing ongoing research and development efforts focused on enhancing engine performance, reducing fuel consumption, and integrating cutting-edge materials that improve durability and operational efficiency. With rising geopolitical tensions and increased investments in air superiority, countries across the world are prioritizing the development and procurement of advanced turbojet engines to maintain strategic advantages in aerial combat.

Technology Impact in Defense Turbojet Engine Market:

Technological advancements are shaping the defense turbojet engine market, with innovations focused on thrust-to-weight ratio improvements, fuel efficiency, and materials science. One of the most significant developments is the integration of advanced composite materials and ceramic matrix composites (CMCs) into engine construction, which enhances thermal resistance and reduces overall weight. This allows for higher operational temperatures and improved engine longevity, crucial factors in high-performance military aviation. Additionally, the incorporation of digital engine control systems, such as Full Authority Digital Engine Control (FADEC), has improved engine responsiveness, optimized fuel consumption, and provided predictive maintenance capabilities, reducing downtime and operational costs. The ongoing development of variable cycle engines, which can adjust airflow and combustion characteristics in real-time, is another transformative trend. These adaptive engines enable greater versatility in military aircraft, allowing for efficient fuel use during subsonic flight while maintaining high-speed performance when needed. Additive manufacturing, or 3D printing, has also revolutionized turbojet production, allowing for rapid prototyping and the creation of complex engine components with improved structural integrity. In addition to these advancements, research into hybrid propulsion systems is gaining traction, with defense contractors exploring the potential for integrating electrical components into turbojet designs to enhance efficiency and reduce thermal signatures.

Key Drivers in Defense Turbojet Engine Market:

Several key factors are driving the growth of the defense turbojet engine market, including increasing defense budgets, the need for enhanced aerial combat capabilities, and the proliferation of missile technology. One of the primary drivers is the global emphasis on maintaining air superiority, as nations seek to develop and deploy high-speed aircraft capable of outmaneuvering adversaries. The rise of hypersonic weapons programs has further intensified investments in advanced turbojet and ramjet propulsion technologies, with leading military powers developing next-generation air-breathing engines for high-speed missiles and unmanned platforms. The continued relevance of turbojet engines in cruise missiles is another major factor propelling market growth. These engines provide the necessary speed and reliability for long-range strike capabilities, making them an essential component of modern military arsenals. In addition, the increasing deployment of unmanned aerial systems for reconnaissance, combat, and electronic warfare applications is driving demand for lightweight, high-thrust turbojet engines capable of supporting rapid maneuverability and extended flight durations. The resurgence of interest in supersonic combat aircraft, including sixth-generation fighter programs, is also influencing turbojet engine development, as military forces seek propulsion solutions that balance speed, efficiency, and stealth characteristics.

Regional Trends in Defense Turbojet Engine Market:

Regional trends in the defense turbojet engine market vary based on military priorities, technological capabilities, and strategic objectives. North America remains a dominant force in turbojet engine development, with the United States leading in both innovation and production. The U.S. military's investments in next-generation aircraft, hypersonic weapons, and advanced missile systems are driving continued research into high-performance turbojet propulsion. Major defense contractors such as Pratt & Whitney, General Electric Aviation, and Honeywell are at the forefront of developing cutting-edge engine technologies, leveraging advancements in materials science, digital control systems, and additive manufacturing. The U.S. Air Force's focus on high-speed strike capabilities, including hypersonic cruise missiles and advanced UAVs, ensures sustained demand for turbojet engine solutions. Additionally, ongoing upgrades to legacy aircraft, such as the B-52 Stratofortress, include engine modernization programs aimed at improving fuel efficiency and performance. Canada, while not a major producer of turbojet engines, remains an important player in research and development collaborations, supporting NATO's strategic initiatives.

In Europe, the defense turbojet engine market is driven by multinational defense projects and a strong emphasis on indigenous engine development. Countries such as France, the United Kingdom, and Germany are leading the charge in high-performance military propulsion technologies, with companies like Rolls-Royce, Safran Aircraft Engines, and MTU Aero Engines developing advanced turbojet and turbofan solutions. The Future Combat Air System (FCAS) and Tempest programs, spearheaded by European nations, include significant investments in next-generation propulsion technologies, ensuring continued advancements in turbojet engine capabilities. France's Safran has been actively working on high-thrust military engines, supporting both national defense programs and international collaborations. The United Kingdom's Rolls-Royce has played a crucial role in developing advanced propulsion solutions for both manned and unmanned aircraft, including efforts to integrate variable cycle engines into future fighter jets. Additionally, Europe's emphasis on cruise missile development, including the MBDA Storm Shadow and the Meteor air-to-air missile, has driven demand for compact, high-efficiency turbojet engines tailored for missile applications.

The Asia-Pacific region is witnessing rapid growth in the defense turbojet engine market, fueled by increasing military expenditures, indigenous defense manufacturing initiatives, and regional security concerns. China has emerged as a major player, investing heavily in the development of high-performance jet engines to reduce reliance on foreign suppliers. The country's efforts to develop indigenous turbojet engines for fighter jets, UAVs, and missile systems underscore its ambition to achieve self-sufficiency in military propulsion technology. China's advancements in hypersonic weapons, including scramjet and ramjet propulsion research, further highlight its strategic focus on high-speed aerial warfare. India is also making significant strides in turbojet engine development, with the Gas Turbine Research Establishment (GTRE) working on indigenous jet propulsion solutions for combat aircraft and cruise missiles. Japan and South Korea, both key defense players in the region, are investing in next-generation propulsion technologies as part of their respective military modernization efforts. Japan's collaboration with international defense contractors on advanced fighter programs, such as the F-X stealth fighter, includes research into high-performance jet engines tailored for future aerial combat.

Key Defense Turbojet Engine Program:

AZAD Engineering Ltd has secured a contract from the Gas Turbine Research Establishment (GTRE), an R&D organization under the Defence Research and Development Organisation (DRDO) and the Union Defence Ministry, to develop advanced turbo engines for India's defense programs. The company announced that it has been selected as GTRE's exclusive industry partner to bring this design to fruition. The contract encompasses the full-scale manufacturing and assembly of a cutting-edge gas turbine engine essential for defense applications.

GE Aerospace has secured a $1.1 billion multiyear contract from the U.S. Department of Defense for the procurement of T700 turbine engines, which will power Army helicopters and support other military branches. Awarded on June 12, the contract is set to run until June 13, 2029, ensuring a steady supply of T700 engines for the Army's Apache and Black Hawk helicopters. Additionally, the engines will be utilized by the Navy, Air Force, and foreign military sales partners. The initial delivery order under the contract includes 20 engines designated for the production line of the Army's UH-60M Black Hawk, the latest variant of the helicopter.

Table of Contents

Defense Turbojet Engines Market Report Definition

Defense Turbojet Engines Market Segmentation

By Region

By Application

By End User

Defense Turbojet Engines Market Analysis for next 10 Years

The 10-year defense turbojet engines market analysis would give a detailed overview of defense turbojet engines market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Turbojet Engines Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Turbojet Engines Market Forecast

The 10-year defense turbojet engines market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Turbojet Engines Market Trends & Forecast

The regional defense turbojet engines market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

REST

Key Companies

Supplier Tier Landscape

Company Benchmarking

Market Forecast & Scenario Analysis

Europe

Middle East

APAC

South America

Country Analysis of Defense Turbojet Engines Market

This chapter deals with the key programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Program Mapping

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Turbojet Engines Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Turbojet Engines Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By End User, 2025-2035

List of Figures

- Figure 1: Global Defense Turbojet Engine Market Forecast, 2025-2035

- Figure 2: Global Defense Turbojet Engine Market Forecast, By Region, 2025-2035

- Figure 3: Global Defense Turbojet Engine Market Forecast, By Application, 2025-2035

- Figure 4: Global Defense Turbojet Engine Market Forecast, By End User, 2025-2035

- Figure 5: North America, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 9: South America, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 10: United States, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 16: France, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 17: France, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 32: India, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 33: India, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 34: China, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 35: China, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Turbojet Engine Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Turbojet Engine Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Turbojet Engine Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Turbojet Engine Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Turbojet Engine Market, By Application (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Turbojet Engine Market, By Application (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Turbojet Engine Market, By End User (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Turbojet Engine Market, By End User (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Turbojet Engine Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Turbojet Engine Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Turbojet Engine Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Turbojet Engine Market, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Turbojet Engine Market, By Application, 2025-2035

- Figure 59: Scenario 1, Defense Turbojet Engine Market, By End User, 2025-2035

- Figure 60: Scenario 2, Defense Turbojet Engine Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Turbojet Engine Market, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Turbojet Engine Market, By Application, 2025-2035

- Figure 63: Scenario 2, Defense Turbojet Engine Market, By End User, 2025-2035

- Figure 64: Company Benchmark, Defense Turbojet Engine Market, 2025-2035