PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1680165

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1680165

Global Defense Helicopter Engine Market 2025-2035

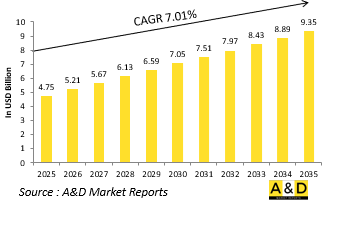

The Global defense helicopter engine market is estimated at USD 4.75 billion in 2025, projected to grow to USD 9.35 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 7.01% over the forecast period 2024-2034.

Introduction to Defense Helicopter Engine Market:

The global defense helicopter engine market is a crucial component of military aviation, supporting a wide range of rotorcraft used for combat, reconnaissance, transport, and search-and-rescue missions. Helicopters play an indispensable role in modern warfare, offering versatility in both offensive and defensive operations. Military forces worldwide rely on these aircraft for their ability to operate in challenging environments, including mountainous regions, dense forests, and urban warfare zones. The engines that power these helicopters must deliver high performance, durability, and efficiency while meeting the stringent demands of military operations. With ongoing defense modernization efforts, increasing geopolitical tensions, and a growing emphasis on multi-role capabilities, demand for advanced helicopter engines is rising globally. Leading defense contractors and engine manufacturers are investing in cutting-edge propulsion technologies to enhance operational effectiveness, fuel efficiency, and maintenance reliability.

Technology Impact in Defense Helicopter Engine Market:

Technology is driving significant advancements in the defense helicopter engine market, with innovations focusing on power-to-weight ratio improvements, fuel efficiency, and extended operational lifespans. One of the most notable breakthroughs is the development of more efficient turboshaft engines, which provide superior power output while reducing overall weight. The use of advanced materials, such as ceramic matrix composites (CMCs) and lightweight alloys, has significantly improved engine heat resistance and durability, allowing helicopters to operate at higher temperatures and altitudes with greater reliability. Digital engine control systems, including Full Authority Digital Engine Control (FADEC), have enhanced engine performance by optimizing fuel consumption, reducing pilot workload, and improving maintenance diagnostics. These smart engine management systems provide real-time monitoring and predictive maintenance capabilities, minimizing downtime and ensuring mission readiness. The integration of hybrid-electric propulsion is another emerging trend, with research underway to develop hybrid-electric helicopters that offer reduced fuel consumption and lower acoustic signatures, making them ideal for stealth operations. Advances in additive manufacturing, or 3D printing, have also transformed the production of complex engine components, reducing lead times and enabling the rapid prototyping of new designs.

Key Drivers in Defense Helicopter Engine Market:

Key drivers fueling the growth of the defense helicopter engine market include increasing military procurement programs, the demand for fleet modernization, and the need for enhanced operational capabilities. Many countries are replacing aging helicopter fleets with modern rotorcraft that feature advanced engines capable of delivering greater speed, payload capacity, and fuel efficiency. The push for multi-role helicopters, which can transition seamlessly between combat, transport, and medical evacuation missions, has led to a rising demand for adaptable and high-performance engines. Additionally, the growing importance of vertical lift capabilities in contested environments has intensified investments in next-generation rotorcraft and propulsion systems. The emergence of Future Vertical Lift (FVL) programs, particularly in the United States, is a major driver shaping the market. These initiatives aim to develop high-speed, long-range military helicopters with state-of-the-art engines that offer superior endurance and survivability. Increased defense budgets across key military powers, including the U.S., China, and European nations, are further accelerating investments in new helicopter engines. Another critical factor is the need for improved fuel efficiency and sustainability, as defense forces seek to reduce logistical challenges and operational costs associated with fuel consumption in prolonged deployments.

Regional Trends in Defense Helicopter Engine Market:

Regional trends in the defense helicopter engine market reflect varying military priorities, technological capabilities, and procurement strategies. North America remains the dominant player, with the United States leading in both innovation and procurement. The U.S. military operates one of the largest helicopter fleets in the world, including models such as the UH-60 Black Hawk, AH-64 Apache, CH-47 Chinook, and the V-22 Osprey. Programs like the Future Long-Range Assault Aircraft (FLRAA) and the Future Attack Reconnaissance Aircraft (FARA) under the FVL initiative are driving demand for next-generation engines with increased power, range, and efficiency. Leading engine manufacturers, including General Electric Aviation, Honeywell, and Rolls-Royce North America, are at the forefront of developing new propulsion technologies to support these advanced rotorcraft. Canada, while operating a smaller military helicopter fleet, continues to invest in engine upgrades and maintenance programs to enhance the performance of its existing aircraft.

In Europe, the defense helicopter engine market is shaped by collaborative programs and national defense strategies. France, Germany, Italy, and the United Kingdom are key players, with companies such as Safran Helicopter Engines, Rolls-Royce, and MTU Aero Engines leading innovation in the region. European nations continue to modernize their helicopter fleets, focusing on platforms such as the NH90, Tiger attack helicopter, and AW101 Merlin. The European Defence Fund and multinational projects support research into more efficient and powerful helicopter engines, ensuring that European forces maintain cutting-edge vertical lift capabilities. The increasing focus on indigenous engine development and reduced reliance on foreign suppliers has led to joint ventures and technology-sharing agreements among European defense contractors.

Key Defense Helicopter Engine Program:

SAFHAL, a joint venture between Safran Helicopter Engines SAS and Hindustan Aeronautics Limited, is dedicated to the design, development, production, sales, and support of next-generation helicopter engines in India. This initiative marks a major milestone in the country's aerospace and defense sector, reinforcing India's commitment to Aatmanirbharta in helicopter engine technology. Under this strategic agreement, SAFHAL will collaborate with its parent companies to develop cutting-edge engine technologies, ensuring exceptional performance, reliability, and operational efficiency. The partnership will focus on advanced design, state-of-the-art manufacturing processes, and rigorous testing protocols, adhering to the highest global standards.

European engine giants MTU Aero Engines and Safran Helicopter Engines have taken a significant step forward in their efforts to develop and produce a powerplant for a future European military helicopter with the establishment of a joint venture. The companies announced the signing of a cooperation agreement to create EURA (European Military Rotorcraft Engine Alliance), a 50-50 partnership aimed at advancing military rotorcraft engine technology. EURA will be led by an MTU executive and will be based alongside Safran Helicopter Engines' headquarters in Bordes, France. This development follows an initial agreement signed a year ago to formalize the collaboration.

Table of Contents

Defense Helicopter Engines Market Report Definition

Defense Helicopter Engines Market Segmentation

By Platform

By Thrust

By Region

Defense Helicopter Engines Market Analysis for next 10 Years

The 10-year defense helicopter engines market analysis would give a detailed overview of defense helicopter engines market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Helicopter Engines Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Helicopter Engines Market Forecast

The 10-year defense helicopter engines market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Helicopter Engines Market Trends & Forecast

The regional defense helicopter engines market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Helicopter Engines Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Helicopter Engines Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Helicopter Engines Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Thrust, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Thrust, 2025-2035

List of Figures

- Figure 1: Global Defense Helicopter Engine Market Forecast, 2025-2035

- Figure 2: Global Defense Helicopter Engine Market Forecast, By Region, 2025-2035

- Figure 3: Global Defense Helicopter Engine Market Forecast, By Platform, 2025-2035

- Figure 4: Global Defense Helicopter Engine Market Forecast, By Thrust, 2025-2035

- Figure 5: North America, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 9: South America, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 10: United States, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 16: France, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 17: France, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 32: India, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 33: India, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 34: China, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 35: China, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Helicopter Engine Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Helicopter Engine Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Helicopter Engine Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Helicopter Engine Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Helicopter Engine Market, By Platform (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Helicopter Engine Market, By Platform (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Helicopter Engine Market, By Thrust (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Helicopter Engine Market, By Thrust (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Helicopter Engine Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Helicopter Engine Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Helicopter Engine Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Helicopter Engine Market, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Helicopter Engine Market, By Platform, 2025-2035

- Figure 59: Scenario 1, Defense Helicopter Engine Market, By Thrust, 2025-2035

- Figure 60: Scenario 2, Defense Helicopter Engine Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Helicopter Engine Market, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Helicopter Engine Market, By Platform, 2025-2035

- Figure 63: Scenario 2, Defense Helicopter Engine Market, By Thrust, 2025-2035

- Figure 64: Company Benchmark, Defense Helicopter Engine Market, 2025-2035