PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1680164

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1680164

Global Defense Air Platforms Engines Market 2025-2035

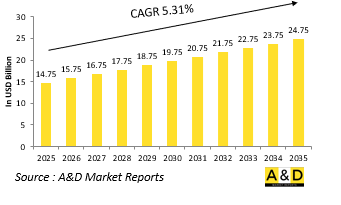

The Global Defense Air Platforms Engines market is estimated at USD 14.75 billion in 2025, projected to grow to USD 24.75 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.31% over the forecast period 2025-2035.

Introduction to Defense Air Platforms Engines Market:

The global defense air platforms engines market is a critical sector within the defense aerospace industry, driven by the increasing demand for high-performance propulsion systems to power military aircraft, including fighter jets, bombers, transport planes, helicopters, and unmanned aerial vehicles (UAVs). As air superiority remains a decisive factor in modern warfare, nations continue to invest in advanced propulsion technologies to enhance speed, fuel efficiency, durability, and stealth capabilities. Military aircraft engines must meet stringent performance requirements, including the ability to operate in extreme conditions, sustain high maneuverability, and support long-range missions. The market is characterized by continuous research and development (R&D) efforts aimed at improving thrust-to-weight ratios, increasing reliability, and reducing maintenance costs. Global defense modernization programs, shifting geopolitical dynamics, and emerging threats are driving investments in next-generation propulsion systems, making this market a key area of focus for defense contractors and military organizations worldwide.

Technology Impact in Defense Air Platforms Engines Market:

Technology plays a transformative role in shaping the defense air platforms engines market, with innovations in materials, manufacturing techniques, and digital integration significantly enhancing engine performance. One of the most notable advancements is the incorporation of adaptive cycle engines, which offer improved fuel efficiency and greater thrust by dynamically adjusting airflow based on mission requirements. These engines, such as those being developed under the U.S. Adaptive Engine Transition Program (AETP), provide superior operational flexibility, allowing aircraft to switch between fuel-saving and high-performance modes seamlessly. Another breakthrough in propulsion technology is the integration of ceramic matrix composites (CMCs), which enhance heat resistance and reduce engine weight, leading to improved efficiency and durability. Additive manufacturing, commonly known as 3D printing, is revolutionizing engine production by enabling the rapid fabrication of complex components with reduced material waste and shorter lead times. The use of digital twins-virtual replicas of physical engines-allows for predictive maintenance and real-time performance monitoring, minimizing downtime and optimizing fleet readiness. Additionally, advancements in hybrid-electric and hydrogen-powered propulsion systems are being explored as part of long-term sustainability efforts, although these technologies are still in their early stages for military applications.

Key Drivers in Defense Air Platforms Engines market:

Several key drivers are propelling growth in the defense air platforms engines market. One of the primary factors is the increasing procurement and upgrade of military aircraft fleets worldwide. Many nations are replacing aging aircraft with modern platforms that require next-generation engines capable of delivering superior performance. The shift towards fifth- and sixth-generation fighter jets, such as the F-35 Lightning II, the Tempest, and the Next Generation Air Dominance (NGAD) program, is fueling demand for more powerful and fuel-efficient engines. Another major driver is the growing emphasis on stealth and survivability. As radar-evading capabilities become crucial in modern aerial warfare, engine manufacturers are focusing on reducing infrared signatures and noise levels to enhance aircraft stealth. The rise of UAVs in defense operations is also expanding market opportunities, with militaries seeking high-endurance engines that enable extended surveillance and strike missions. Furthermore, the increasing frequency of joint defense programs and multinational collaborations is fostering innovation in engine development, as allied nations pool resources to accelerate technological advancements and cost-sharing initiatives.

Regional Trends in Defense Air Platforms Engines Market:

In the Middle East, defense air platform engine demand is driven by military modernization efforts and increased procurement of advanced fighter jets. Gulf Cooperation Council (GCC) nations, including Saudi Arabia and the United Arab Emirates, are investing in new-generation aircraft and maintenance capabilities to enhance their aerial defense systems. These countries frequently procure Western-made aircraft, such as the F-15, F-16, and F-35, which rely on engines supplied by leading U.S. and European manufacturers. The region's harsh climatic conditions also necessitate specialized engine adaptations to ensure operational reliability in extreme temperatures and sand-laden environments. Additionally, partnerships with Western defense companies are facilitating technology transfers and local maintenance capabilities, strengthening the regional defense aerospace sector.

Africa's defense air platforms engines market is relatively smaller compared to other regions but is gradually expanding as nations seek to modernize their air forces. Many African countries operate legacy aircraft that require engine upgrades or replacements, creating opportunities for maintenance, repair, and overhaul (MRO) services. Nations such as Algeria, Egypt, and South Africa are among the leading defense aviation players in the region, investing in both Western and Russian-built aircraft. Additionally, increased counterterrorism operations and border security concerns are driving demand for military transport aircraft and helicopter engines, supporting regional security efforts.

Key Defense Air Platforms Engines Program:

In a significant boost to the Aatmanirbhar Bharat initiative, the Ministry of Defence (MoD) has signed a contract with Hindustan Aeronautics Limited (HAL) for the procurement of 240 AL-31FP aero engines for the Su-30MKI aircraft, valued at over Rs 26,000 crore. The agreement was formalized in New Delhi on September 9, 2024, in the presence of Defence Secretary Shri Giridhar Aramane, Secretary (Defence Production) Shri Sanjeev Kumar, and Chief of the Air Staff Air Chief Marshal VR Chaudhari. The engines will be produced at HAL's Koraput Division and will play a crucial role in maintaining the Indian Air Force's Su-30 fleet, ensuring sustained operational capability for national defense. Under the contractual schedule, HAL will supply 30 engines annually, with all 240 engines expected to be delivered over the next eight years.

In a major advancement for defense aviation, GE Aerospace has signed a five-year Performance-Based Logistics (PBL) contract with the Indian Air Force (IAF) to provide sustainment solutions for the T700-GE-701D engines powering the IAF's AH-64E-I Apache helicopters. This agreement strengthens the long-standing partnership between GE Aerospace and the IAF, highlighting the critical role of reliable maintenance and operational readiness for key defense assets.As part of the contract, GE Aerospace will manage the Maintenance, Repair, and Overhaul (MRO) of the T700 engines while also supplying flight line parts to ensure consistent engine availability. The PBL framework aims to streamline sustainment operations, minimize turnaround times, and improve the overall efficiency of the Apache helicopter fleet. By adopting a more integrated and performance-driven logistics approach, this collaboration ensures that the IAF's Apache helicopters remain mission-ready and fully operational.

Table of Contents

Defense Air Platforms Engines Market Report Definition

Defense Air Platforms Engines Market Segmentation

By Region

By Application

By End User

Defense Air Platforms Engines Market Analysis for next 10 Years

The 10-year defense air platforms engines market analysis would give a detailed overview of defense air platforms engines market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Air Platforms Engines Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Air Platforms Engines Market Forecast

The 10-year defense air platforms engines market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Air Platforms Engines Market Trends & Forecast

The regional defense air platforms engines market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

REST

Key Companies

Supplier Tier Landscape

Company Benchmarking

Market Forecast & Scenario Analysis

Europe

Middle East

APAC

South America

Country Analysis of Defense Air Platforms Engines Market

This chapter deals with the key programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Program Mapping

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Air Platforms Engines Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Air Platforms Engines Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By End User, 2025-2035

List of Figures

- Figure 1: Global Defense Air Platforms Engines Market Forecast, 2025-2035

- Figure 2: Global Defense Air Platforms Engines Market Forecast, By Region, 2025-2035

- Figure 3: Global Defense Air Platforms Engines Market Forecast, By Application, 2025-2035

- Figure 4: Global Defense Air Platforms Engines Market Forecast, By End User, 2025-2035

- Figure 5: North America, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 9: South America, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 10: United States, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 16: France, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 17: France, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 32: India, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 33: India, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 34: China, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 35: China, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Air Platforms Engines Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Air Platforms Engines Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Air Platforms Engines Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Air Platforms Engines Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Air Platforms Engines Market, By Application (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Air Platforms Engines Market, By Application (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Air Platforms Engines Market, By End User (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Air Platforms Engines Market, By End User (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Air Platforms Engines Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Air Platforms Engines Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Air Platforms Engines Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Air Platforms Engines Market, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Air Platforms Engines Market, By Application, 2025-2035

- Figure 59: Scenario 1, Defense Air Platforms Engines Market, By End User, 2025-2035

- Figure 60: Scenario 2, Defense Air Platforms Engines Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Air Platforms Engines Market, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Air Platforms Engines Market, By Application, 2025-2035

- Figure 63: Scenario 2, Defense Air Platforms Engines Market, By End User, 2025-2035

- Figure 64: Company Benchmark, Defense Air Platforms Engines Market, 2025-2035