PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1556133

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1556133

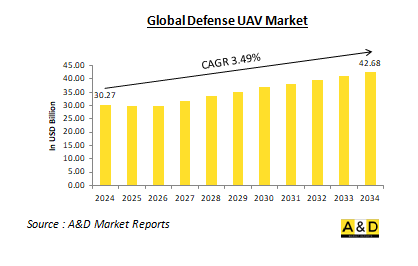

Global Defense UAV Market 2024-2034

The Global Defense UAV Market is estimated at USD 30.27 billion in 2024, projected to grow to USD 42.68 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 3.49% over the forecast period 2024-2034

Introduction to Global Defense UAV Market:

Unmanned Aerial Vehicles (UAVs), commonly known as drones, have become a cornerstone of modern military operations, revolutionizing defense strategies and tactics across the globe. These aircraft, which operate without onboard human pilots, are increasingly being deployed for a wide range of defense applications, from reconnaissance and surveillance to targeted strikes and logistical support. The global defense UAV market is expanding rapidly, driven by technological advancements, evolving military needs, and increasing geopolitical tensions. UAVs offer a unique combination of versatility, cost-efficiency, and operational flexibility, making them indispensable in contemporary warfare and defense operations.

Technology Impact in Global Defense UAV Market:

Technology's impact on global defense UAVs is both profound and multifaceted, significantly influencing their development and deployment across various dimensions. One of the most notable advancements is in advanced sensor technologies. Modern defense UAVs are outfitted with high-resolution cameras, infrared sensors, and radar systems that greatly enhance their reconnaissance and surveillance capabilities. These sensors allow UAVs to gather detailed intelligence, conduct extensive surveillance, and perform precise targeting, thereby improving situational awareness and operational effectiveness.

Another critical area of impact is autonomous capabilities. The integration of artificial intelligence (AI) and machine learning into UAV systems is revolutionizing their operational functionality. Autonomous UAVs are now capable of executing complex missions with minimal human intervention, such as navigation, target identification, and threat detection. AI-driven systems boost the efficiency and accuracy of UAV operations, enabling them to adapt to changing environments and perform tasks with greater precision. Communication and data link systems also play a crucial role in the effectiveness of defense UAVs. Advances in satellite communication, secure data links, and real-time data transmission technologies ensure continuous communication between UAVs and ground control stations. This connectivity facilitates the relay of critical information back to military command centers and supports remote piloting and real-time mission management, thereby enhancing overall operational effectiveness.

Furthermore, to operate successfully in contested environments, defense UAVs are increasingly incorporating stealth and evasion technologies. These include design features that reduce radar cross-sections, advanced materials that minimize infrared signatures, and electronic countermeasures that disrupt enemy radar and communication systems. Such technologies allow UAVs to carry out missions in hostile areas while minimizing the risk of detection and engagement by enemy forces. Lastly, the concept of swarming and networked operations is gaining prominence in modern defense strategies. UAV swarming involves deploying multiple drones that operate in coordinated groups, allowing for the execution of complex missions collectively. Networked operations enable these UAVs to share information and coordinate actions in real time, thereby enhancing their effectiveness and providing more robust defensive and offensive capabilities.

Key Drivers in Global Defense UAV Market:

Several key factors are driving the growth and development of the global defense UAV market. Geopolitical tensions and regional conflicts are significantly contributing to the increased demand for advanced defense UAVs. Nations are investing heavily in UAV technology to enhance their military capabilities, gather intelligence, and carry out precise strikes. This need for strategic advantages in conflict-prone areas like the Middle East and Eastern Europe is leading to substantial investments in UAV technology. Technological advancements are another major driver of market growth. Innovations in sensor technology, artificial intelligence (AI), communication systems, and materials science are expanding the capabilities of defense UAVs, making them more effective and versatile. As these technologies evolve, UAVs are becoming increasingly capable of executing complex missions and operating in more challenging environments. Cost efficiency also plays a crucial role in driving the adoption of UAVs. Compared to manned aircraft and traditional military assets, UAVs offer a more cost-effective solution due to their lower operational and maintenance costs. This makes them an attractive option for defense forces aiming to optimize their budgets while maintaining high operational effectiveness. The ability to deploy UAVs for a range of missions without the expense associated with manned aircraft is further accelerating their adoption in various military and defense applications. The rise of asymmetric warfare is another factor fueling UAV demand. In conflicts where smaller, agile forces challenge larger, technologically advanced opponents, UAVs provide a strategic advantage by offering superior reconnaissance, surveillance, and precision strike capabilities. They enable smaller forces to effectively counter larger, conventional adversaries and achieve tactical and strategic objectives more efficiently. Finally, increased defense budgets are driving investments in advanced technologies, including UAVs. Many countries are boosting their defense spending to address emerging threats and enhance their military capabilities. This increase in defense budgets is leading governments to allocate funds for the development and acquisition of cutting-edge UAV systems, providing a competitive edge in various defense scenarios.

Regional Trends in Global Defense UAV Market:

The global defense UAV market displays distinct regional trends, influenced by local defense priorities, technological advancements, and geopolitical factors: In North America, particularly the United States, the market is dominated by significant investments in advanced UAV systems. The U.S. has been at the forefront of UAV development and deployment, focusing on reconnaissance, surveillance, and combat operations. Major defense contractors, such as General Atomics and Northrop Grumman, are leading the charge in developing state-of-the-art UAV technologies. The U.S. military's extensive use of UAVs, supported by substantial defense budgets, reinforces the region's position as a market leader. In Europe, countries like the United Kingdom, France, and Germany are making considerable investments in UAV technology to bolster their defense capabilities. European nations are focusing on developing sophisticated UAV systems for intelligence gathering, surveillance, and tactical operations. Initiatives such as the European Defence Fund (EDF) are promoting the development of next-generation UAV technologies and encouraging collaboration among European defense industries. The Asia-Pacific region is witnessing rapid growth in the defense UAV market, fueled by increased defense budgets and escalating geopolitical tensions. Nations such as China, India, and Japan are heavily investing in UAV technology to modernize their military forces and strengthen their strategic capabilities. China, in particular, is advancing its UAV capabilities with a focus on both offensive and defensive applications. Meanwhile, India and Japan are expanding their UAV fleets to address regional security challenges. In the Middle East, defense UAVs are increasingly being utilized to tackle regional conflicts and security issues. Countries including Israel, Saudi Arabia, and the United Arab Emirates are investing in UAV technology for intelligence, surveillance, and strike missions. The deployment of UAVs in this region underscores the need for advanced capabilities to address threats and maintain strategic advantages in a volatile geopolitical environment. In Africa, the defense UAV market is growing, though at a slower pace compared to other regions. Countries such as South Africa and Egypt are exploring UAV technology to enhance their defense capabilities and address security concerns. The adoption of UAVs in Africa is driven by the need for effective surveillance and reconnaissance solutions to manage ongoing conflicts and security challenges.

Key Defense UAV Programs:

US Army Receives First EAGLS Laser-Guided Counter-Drone System.The US Army has received the first EAGLS counter-drone system from MSI Defence Solutions.According to the North Carolina-based company, six systems have been contracted to help "forward deployed forces facing emerging and persistent uncrewed aerial systems threats."The Naval Air Systems Command, acting through the Rapid Acquisition Authority, granted the contract, which included related engineering and maintenance assistance. The business was contracted to provide five EAGLS to the US Central Command Area of Responsibility, which includes the Middle East, Central Asia, and portions of South Asia, according to an earlier US Department of Defence contract notice.

Italy Cleared to Buy Six MQ-9 Reaper Drones for $738M.The prospective foreign military sale, valued at $738 million, includes the delivery of three mobile ground control stations and six Block 5 Reaper drones.Should the deal proceed, Rome will also receive nine AN/APY-8 synthetic aperture radars and twelve multispectral target systems.Additionally, General Atomics will offer staff training, related spare parts, and essential maintenance support services.The planned sale "will support the foreign policy goals and national security objectives of the US by improving the security of a NATO ally," according to the US Defence Security Cooperation Agency.The announcement of the overseas military sale had no timeframe.

Table of Contents

Defense UAV Market Report Definition

Defense UAV Market Segmentation

By Region

By Propulsion

By End-User

Defense UAV Market Analysis for next 10 Years

The 10-year Defense UAV Market analysis would give a detailed overview of Defense UAV Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense UAV Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense UAV Market Forecast

The 10-year Defense UAV Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense UAV Market Trends & Forecast

The regional Defense UAV Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense UAV Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense UAV Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense UAV Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Propulsion, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By End User, 2022-2032

- Table 20: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Propulsion, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By End User, 2022-2032

List of Figures

- Figure 1: Global Defense UAV Market Market Forecast, 2022-2032

- Figure 2: Global Defense UAV Market Market Forecast, By Region, 2022-2032

- Figure 3: Global Defense UAV Market Market Forecast, By Propulsion, 2022-2032

- Figure 4: Global Defense UAV Market Market Forecast, By End User, 2022-2032

- Figure 5: North America, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 6: Europe, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 7: Middle East, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 8: APAC, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 9: South America, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 10: United States, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 11: United States, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 12: Canada, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 13: Canada, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 14: Italy, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 15: Italy, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 16: France, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 17: France, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 18: Germany, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 19: Germany, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 20: Netherlands, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 21: Netherlands, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 22: Belgium, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 23: Belgium, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 24: Spain, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 25: Spain, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 26: Sweden, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 27: Sweden, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 28: Brazil, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 29: Brazil, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 30: Australia, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 31: Australia, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 32: India, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 33: India, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 34: China, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 35: China, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 36: Saudi Arabia, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 37: Saudi Arabia, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 38: South Korea, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 39: South Korea, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 40: Japan, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 41: Japan, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 42: Malaysia, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 43: Malaysia, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 44: Singapore, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 45: Singapore, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 46: United Kingdom, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 47: United Kingdom, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 48: Opportunity Analysis, Defense UAV Market Market, By Region (Cumulative Market), 2022-2032

- Figure 49: Opportunity Analysis, Defense UAV Market Market, By Region (CAGR), 2022-2032

- Figure 50: Opportunity Analysis, Defense UAV Market Market, By Propulsion (Cumulative Market), 2022-2032

- Figure 51: Opportunity Analysis, Defense UAV Market Market, By Propulsion (CAGR), 2022-2032

- Figure 52: Opportunity Analysis, Defense UAV Market Market, By End User (Cumulative Market), 2022-2032

- Figure 53: Opportunity Analysis, Defense UAV Market Market, By End User (CAGR), 2022-2032

- Figure 54: Scenario Analysis, Defense UAV Market Market, Cumulative Market, 2022-2032

- Figure 55: Scenario Analysis, Defense UAV Market Market, Global Market, 2022-2032

- Figure 56: Scenario 1, Defense UAV Market Market, Total Market, 2022-2032

- Figure 57: Scenario 1, Defense UAV Market Market, By Region, 2022-2032

- Figure 58: Scenario 1, Defense UAV Market Market, By Propulsion, 2022-2032

- Figure 59: Scenario 1, Defense UAV Market Market, By End User, 2022-2032

- Figure 60: Scenario 2, Defense UAV Market Market, Total Market, 2022-2032

- Figure 61: Scenario 2, Defense UAV Market Market, By Region, 2022-2032

- Figure 62: Scenario 2, Defense UAV Market Market, By Propulsion, 2022-2032

- Figure 63: Scenario 2, Defense UAV Market Market, By End User, 2022-2032

- Figure 64: Company Benchmark, Defense UAV Market Market, 2022-2032