PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1896747

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1896747

Global Defense Telemetry Market 2026-2036

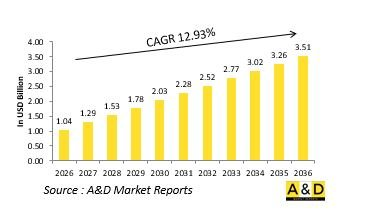

The Global Defense Telemetry market is estimated at USD 1.04 billion in 2026, projected to grow to USD 3.51 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 12.93% over the forecast period 2026-2036.

Introduction to Defense Telemetry Market

The defense telemetry market focuses on systems and technologies that collect, transmit, and analyze data from remote or moving defense assets in real time. Telemetry enables defense organizations to monitor the performance, behavior, and health of weapon systems, aircraft, missiles, and space platforms during operations and testing. It serves as a critical link between deployed systems and command centers, supporting decision-making, mission planning, and post-mission analysis. By providing accurate and continuous data on parameters such as speed, temperature, pressure, and system integrity, telemetry ensures operational safety and reliability. As modern defense platforms become increasingly complex and data-driven, telemetry has evolved into a vital enabler of network-centric warfare, enhancing situational awareness and system efficiency. Its applications span across flight testing, missile guidance, and remote surveillance, reinforcing its central role in defense modernization and performance validation.

Technology Impact in Defense Telemetry Market:

Technological advancements are reshaping the defense telemetry market by enhancing data transmission speed, security, and integration. The adoption of advanced encryption ensures that transmitted data remains secure against interception and cyber threats. The integration of satellite and high-frequency communication technologies has expanded telemetry coverage to remote and hostile environments, enabling real-time data sharing across domains. Miniaturized sensors and high-bandwidth transceivers allow seamless telemetry integration into compact and high-speed platforms. Artificial intelligence and big data analytics are being leveraged to process massive telemetry datasets, transforming raw sensor data into actionable insights for predictive maintenance and mission optimization. Cloud computing and edge processing have also made data access faster and more flexible, supporting collaborative operations among allied forces. These innovations collectively strengthen telemetry's role as a digital backbone of modern defense systems, enabling smarter, faster, and more secure data-driven operations.

Key Drivers in Defense Telemetry Market:

The defense telemetry market is driven by the growing need for real-time data acquisition, system monitoring, and operational analysis. The increasing complexity of modern defense platforms, including advanced missiles, unmanned systems, and space-based assets, has heightened the demand for telemetry systems that can capture and transmit large volumes of data with precision. Governments and defense agencies are prioritizing telemetry to enhance test range efficiency, ensure equipment reliability, and validate system performance under diverse conditions. The shift toward network-centric warfare and digital command structures further underscores the importance of telemetry in ensuring seamless information flow between platforms and control centers. Rising investments in missile testing, flight validation, and space exploration programs are also fueling market growth. Additionally, the emphasis on remote and autonomous operations has expanded telemetry's applications in real-time tracking and decision support, making it an indispensable component of defense capability development.

Regional Trends in Defense Telemetry Market:

Regional dynamics in the defense telemetry market reflect varying strategic and technological priorities. North America leads through extensive investments in missile and aerospace telemetry systems, supported by strong research infrastructure and advanced communication networks. Europe focuses on secure telemetry integration for collaborative defense programs and test range modernization. The Asia-Pacific region is witnessing rapid growth due to increasing missile development, satellite launches, and modernization of testing facilities. The Middle East emphasizes telemetry for air defense and surveillance programs aimed at enhancing regional security. Latin America and Africa are progressively adopting telemetry technologies through defense partnerships and indigenous capability building. Across regions, trends point toward the integration of encrypted, satellite-based, and AI-enabled telemetry networks to support joint operations and enhance mission reliability. This global shift reflects telemetry's growing importance as a strategic enabler of precision warfare, performance assessment, and technological superiority in defense operations.

Key Defense Telemetry Program:

Kratos Secures $3.2 Million Contract to Supply Telemetry, Tracking, and Flight Safety Electronics for U.S. Air Force Missile Program. Kratos Defense & Security Solutions, a leading provider of national security solutions, announced that its recently acquired subsidiary, Herley Lancaster, based in Lancaster, Pennsylvania, has been awarded a contract worth approximately $3.2 million. The contract covers the production of flight termination transponders for use in a U.S. Air Force missile program.

Table of Contents

Defense Telemetry Market - Table of Contents

Defense Telemetry Market Report Definition

Defense Telemetry Market Segmentation

By Region

By Technology

By System

Defense Telemetry Market Analysis for next 10 Years

The 10-year Defense Telemetry Market analysis would give a detailed overview of Defense Telemetry Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Telemetry Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Telemetry Market Forecast

The 10-year Defense Telemetry Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Telemetry Market Trends & Forecast

The regional Defense Telemetry Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Telemetry Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Telemetry Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Telemetry Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Defense Telemetry Forecast, 2025-2035

- Figure 2: Global Defense Telemetry Forecast, By Region, 2025-2035

- Figure 3: Global Defense Telemetry Forecast, By Type, 2025-2035

- Figure 4: Global Defense Telemetry Forecast, By Application, 2025-2035

- Figure 5: North America, Defense Telemetry, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Telemetry, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Telemetry, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Telemetry, Market Forecast, 2025-2035

- Figure 9: South America, Defense Telemetry, Market Forecast, 2025-2035

- Figure 10: United States, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Telemetry, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Telemetry, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Telemetry, Market Forecast, 2025-2035

- Figure 16: France, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 17: France, Defense Telemetry, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Telemetry, Market Forecast, 2025-2035

- Figure 20: Netherlands, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Defense Telemetry, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Telemetry, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Telemetry, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Telemetry, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Telemetry, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Telemetry, Market Forecast, 2025-2035

- Figure 32: India, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 33: India, Defense Telemetry, Market Forecast, 2025-2035

- Figure 34: China, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 35: China, Defense Telemetry, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Telemetry, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Telemetry, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Telemetry, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Telemetry, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Telemetry, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Telemetry, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Telemetry, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Telemetry, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Telemetry, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Telemetry, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Telemetry, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Telemetry, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Telemetry, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Telemetry, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Telemetry, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Telemetry, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Telemetry, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Telemetry, By Type, 2025-2035

- Figure 59: Scenario 1, Defense Telemetry, By Application, 2025-2035

- Figure 60: Scenario 2, Defense Telemetry, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Telemetry, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Telemetry, By Type, 2025-2035

- Figure 63: Scenario 2, Defense Telemetry, By Application, 2025-2035

- Figure 64: Company Benchmark, Defense Telemetry, 2025-2035