PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1546377

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1546377

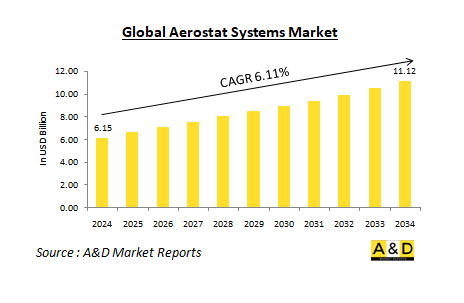

Global Aerostat Systems Market 2024-2034

The Global Aerostat market is estimated at USD 6.15 billion in 2024, projected to grow to USD 11.12 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 6.11% over the forecast period 2024-2034

Introduction to the Aerostat Systems Market:

The aerostat systems market involves the development, deployment, and utilization of large, balloon-like structures, such as aerostats, for a variety of applications, including surveillance, communications, and environmental monitoring. Aerostats are tethered to the ground and operate at high altitudes, typically between 1,000 to 6,000 meters (3,300 to 20,000 feet), providing extended coverage and persistent presence over large areas. Unlike traditional aircraft or satellites, aerostats offer a cost-effective solution with the ability to hover over specific areas for extended periods. This capability makes them highly valuable for military and defense operations, disaster response, border surveillance, and infrastructure monitoring. The market for aerostat systems is expanding as advancements in technology enhance their functionality and as demand grows for persistent, real-time data collection across diverse sectors.

Technology Impact in the Aerostat Systems Market:

Technological advancements have significantly impacted the aerostat systems market, driving innovations that enhance their performance, reliability, and versatility. One of the most notable technological impacts is the improvement in aerostat design and materials. Modern aerostats use advanced composites and lightweight materials that improve their durability and aerodynamic efficiency. These materials also enhance the payload capacity, allowing for the integration of sophisticated sensors and communication equipment. The integration of high-resolution imaging systems and advanced radar technology is another key technological advancement. Modern aerostats are equipped with cutting-edge sensors that provide high-definition surveillance and real-time monitoring capabilities. This includes electro-optical and infrared cameras, synthetic aperture radar (SAR), and other advanced payloads that enhance their ability to detect and track targets across large areas and in various weather conditions. Additionally, advancements in tether technology have improved the stability and reliability of aerostat systems. Modern tethers are designed to withstand harsh environmental conditions and provide reliable power and data transmission between the aerostat and the ground station. This stability is crucial for maintaining the aerostat's position and ensuring uninterrupted data collection and communication. The development of autonomous and semi-autonomous control systems has also revolutionized the aerostat market. These systems allow for more precise control and navigation of aerostats, reducing the need for constant manual intervention. Advanced software and control algorithms enable aerostats to automatically adjust their position and orientation to optimize their surveillance or communication tasks.

Key Drivers in the Aerostat Systems Market:

Several key drivers are fueling the growth of the aerostat systems market. First, the increasing demand for persistent surveillance and reconnaissance capabilities is a major factor. Aerostats offer a unique advantage in providing continuous, high-altitude observation over large areas, which is essential for military and defense operations, border control, and disaster management. Their ability to remain stationary and provide real-time data makes them an attractive solution for applications that require prolonged monitoring. Second, the rising focus on homeland security and border surveillance is driving market growth. Governments and security agencies are investing in aerostat systems to enhance their ability to monitor and protect national borders, detect illegal activities, and respond to security threats. The persistent surveillance capabilities of aerostats make them particularly effective in areas where ground-based or satellite systems may be less practical. Third, advancements in technology and decreasing costs of aerostat systems are contributing to market expansion. As technology improves and production techniques become more efficient, the cost of deploying and maintaining aerostat systems has decreased. This has made them more accessible to a wider range of users, including smaller defense organizations, law enforcement agencies, and commercial enterprises. Additionally, the increasing application of aerostats in non-defense sectors is driving market growth. Aerostats are being used for a variety of purposes beyond military and security applications, including environmental monitoring, infrastructure inspection, and telecommunications. For example, aerostats can be deployed to monitor weather patterns, track wildlife, or provide temporary communication networks in remote areas.

Finally, the growing emphasis on disaster response and management is another key driver. Aerostats can play a crucial role in providing real-time situational awareness during natural disasters such as hurricanes, earthquakes, and floods. Their ability to provide a broad and continuous view of affected areas helps emergency responders coordinate their efforts and improve the efficiency of disaster relief operations.

Regional Trends in the Aerostat Systems Market:

Regional trends in the aerostat systems market reflect varying priorities, technological capabilities, and investment levels across different parts of the world. In North America, particularly the United States, the aerostat market is well-established and growing. The U.S. military and defense agencies have been early adopters of aerostat technology, utilizing it for a range of applications including border security, surveillance, and reconnaissance. Additionally, advancements in technology and substantial defense budgets continue to drive innovation and investment in aerostat systems within the region. In Europe, the aerostat market is characterized by a strong focus on defense and security applications. Countries such as the UK, France, and Germany are investing in aerostat systems to enhance their border surveillance and counter-terrorism capabilities. The European Union's emphasis on improving security and defense infrastructure also supports market growth in this region. Moreover, European countries are increasingly exploring the use of aerostats for non-defense applications, including environmental monitoring and disaster response. The Asia-Pacific region is experiencing significant growth in the aerostat systems market, driven by rapid urbanization, increasing defense budgets, and growing security concerns. Countries like China, India, and Japan are investing in advanced aerostat technologies to bolster their surveillance and reconnaissance capabilities. The region's dynamic economic development and technological advancements contribute to a rising demand for aerostat systems, particularly for border security and disaster management. In the Middle East, the aerostat market is influenced by ongoing regional conflicts and security challenges. Countries in this region are investing in aerostat systems to enhance their military capabilities and improve border surveillance. The persistent need for enhanced security and surveillance in a region with complex geopolitical dynamics drives market growth. In Africa, the aerostat systems market is still developing but shows promise due to increasing investments in security and infrastructure. The need for effective border control and surveillance in many African countries is driving interest in aerostat technology. Additionally, the potential applications of aerostats for environmental monitoring and disaster response are beginning to gain recognition. Overall, the aerostat systems market is experiencing growth across various regions, driven by technological advancements, increasing demand for surveillance and security solutions, and diverse applications in both defense and non-defense sectors. As technology continues to evolve and the need for persistent, real-time monitoring becomes more pronounced, the market for aerostat systems is expected to expand and innovate further.

Key Aerostat Systems Market Program:

The U.S. State Department has approved a Foreign Military Sale to Poland for Airspace and Surface Radar Reconnaissance (ASRR) aerostat systems as part of the Combined Joint

All-Domain Command and Control (CJADC2) effort, the Defense Security Cooperation Agency (DSCA) announced on January 7, 2024. In this project, which is expected to cost $1.2 billion, TCOM, L.P., Raytheon Intelligence and Space, ELTA North America, and QinetiQ were appointed principal contractors.

The Russian Aerostat-Based Drone Defense System is unveiled.With the launch of a new anti-drone defensive system named Barrier, created by the Russian business Pervyy Dirizhabl

(First Dirigible), the Russian defense sector has made tremendous progress. This system counters unmanned aerial vehicles (UAVs) by using aerostat technology, also referred to as barrage balloons.

Table of Contents

Aerostat Systems Market Report Definition

Aerostat Systems Market Segmentation

By Propulsion

By Region

By Type

Aerostat Systems Market Analysis for next 10 Years

The 10-year Aerostat Systems Market analysis would give a detailed overview of Aerostat Systems Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Aerostat Systems Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Aerostat Systems Market Forecast

The 10-year Aerostat Systems Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Aerostat Systems Market Trends & Forecast

The regional Aerostat Systems Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Aerostat Systems Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Aerostat Systems Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Aerostat Systems Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Propulsion, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By Type, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Propulsion, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By Type, 2024-2034

List of Figures

- Figure 1: Global Aerostat Systems Market Forecast, 2024-2034

- Figure 2: Global Aerostat Systems Market Forecast, By Region, 2024-2034

- Figure 3: Global Aerostat Systems Market Forecast, By Propulsion, 2024-2034

- Figure 4: Global Aerostat Systems Market Forecast, By Type, 2024-2034

- Figure 5: North America, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 6: Europe, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 8: APAC, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 9: South America, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 10: United States, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 11: United States, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 12: Canada, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 14: Italy, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 16: France, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 17: France, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 18: Germany, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 24: Spain, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 30: Australia, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 32: India, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 33: India, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 34: China, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 35: China, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 40: Japan, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Aerostat Systems Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Aerostat Systems Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Aerostat Systems Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Aerostat Systems Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Aerostat Systems Market, By Propulsion (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Aerostat Systems Market, By Propulsion (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Aerostat Systems Market, By Type (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Aerostat Systems Market, By Type (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Aerostat Systems Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Aerostat Systems Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Aerostat Systems Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Aerostat Systems Market, By Region, 2024-2034

- Figure 58: Scenario 1, Aerostat Systems Market, By Propulsion, 2024-2034

- Figure 59: Scenario 1, Aerostat Systems Market, By Type, 2024-2034

- Figure 60: Scenario 2, Aerostat Systems Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Aerostat Systems Market, By Region, 2024-2034

- Figure 62: Scenario 2, Aerostat Systems Market, By Propulsion, 2024-2034

- Figure 63: Scenario 2, Aerostat Systems Market, By Type, 2024-2034

- Figure 64: Company Benchmark, Aerostat Systems Market, 2024-2034