PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1528165

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1528165

Global Defense Inertial Navigation System Market 2024-2034

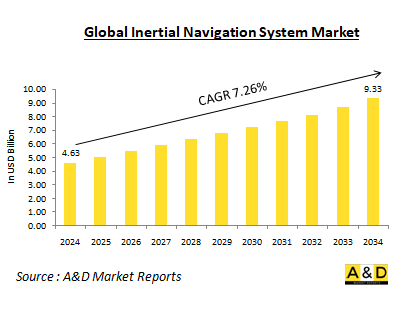

The Global Inertial Navigation System Market is estimated at USD 4.63 billion in 2024, projected to grow to USD 9.33 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 7.26% over the forecast period 2024-2034

Introduction to Defense Inertial Navigation Systems Market:

An Inertial Navigation System (INS) is a self-contained navigation system that uses accelerometers and gyroscopes to measure acceleration and angular rate. By integrating these measurements over time, the system can determine the position, orientation, and velocity of a moving object without relying on external references like GPS. This independence makes INS crucial for military applications, where GPS signals can be jammed or spoofed. In the defense sector, INS is employed across a wide range of platforms, including aircraft, ships, submarines, missiles, and ground vehicles. It provides the foundation for accurate navigation, guidance, and control systems.

Technology Impact in Defense Inertial Navigation Systems Market:

Advancements in technology have significantly enhanced the capabilities of Inertial Navigation Systems (INS). One key development is miniaturization, which has made modern INS components smaller and lighter, allowing for their integration into compact platforms such as drones and missiles. This reduction in size has expanded the range of applications for INS technology. Additionally, there has been a notable increase in accuracy, driven by improvements in sensors and algorithms that enhance the precision of position, velocity, and attitude determinations. Another important advancement is sensor fusion, which involves combining INS data with inputs from other sensors like GPS and magnetometers. This integration improves the overall accuracy and reliability of the system, providing more robust navigational solutions. The use of Micro electromechanical Systems (MEMS) technology has also played a crucial role, reducing the cost of INS components and making them more accessible for a variety of applications. Finally, Fiber Optic Gyroscopes (FOGs) have emerged as a superior alternative to traditional mechanical gyroscopes, offering enhanced performance in terms of accuracy and reliability. These technological advancements collectively contribute to the significant enhancement of INS capabilities.

Key Drivers in Defense Inertial Navigation Systems Market:

Several factors are driving the development and adoption of Inertial Navigation Systems (INS) in the defense sector. One major factor is GPS vulnerability. The increasing threat of GPS jamming and spoofing underscores the need for independent navigation systems like INS, which can provide reliable guidance even when GPS signals are compromised. Another key driver is the demand for precision strike capabilities. Accurate weapon delivery relies on precise navigation, making INS a crucial component in ensuring that munitions hit their intended targets with high precision. The rise of autonomous systems also fuels the adoption of INS. Unmanned vehicles and autonomous platforms require robust navigation solutions to operate effectively, and INS is a key enabler of their functionality and reliability. In the realm of underwater operations, submarines and other underwater vehicles depend heavily on INS due to the absence of GPS signals in submerged environments. INS provides the necessary navigation data to support these missions. Finally, cost reduction plays a significant role. Advances in technology have made INS more affordable, broadening its applications across various defense systems and platforms.

Regional Trends in Defense Inertial Navigation Systems Market:

Regional trends in the development and adoption of Inertial Navigation Systems (INS) are shaped by various factors, including defense budgets, technological capabilities, and geopolitical priorities. In the United States, which is a global leader in defense technology, significant investments have been made in INS research and development. The focus is on advancing INS systems for both strategic and tactical applications. The US prioritizes cutting-edge technologies to maintain its military edge and enhance operational effectiveness across various platforms. European countries are actively collaborating on INS development, particularly through initiatives like the Galileo satellite navigation system. There is a strong emphasis on civil-military dual-use technologies, which aim to integrate advancements in INS with broader applications, supporting both defense and civilian needs. Russia, with its long history of INS development, continues to invest heavily in this technology, focusing on military applications such as ballistic missiles and submarines. The country's efforts are geared towards enhancing its strategic capabilities and ensuring the reliability of its defense systems. China is making rapid advancements in its INS capabilities, driven by a growing defense industry and substantial investments in research and development. The goal is to reduce reliance on foreign technology and enhance domestic capabilities to support its expanding military and strategic interests. Israel, known for its technological prowess, has developed advanced INS systems for both defense and commercial applications. The country leverages its expertise to produce sophisticated navigation solutions that cater to a variety of needs, reflecting its strong position in the global technology landscape.

Key Defense Inertial Navigation Systems Program:

Exail has won a significant contract with Rheinmetall to deliver 1,004 units of its Advans Ursa inertial navigation systems (INS) for the German Army's Caracal 4x4 vehicles. This deal follows Rheinmetall's recent, more extensive contract to supply over 3,000 Caracal airmobile platforms to the armed forces of Germany and the Netherlands.

Honeywell International Inc., located in Minneapolis, has been awarded a firm-fixed-price requirements contract valued at approximately $12,045,229 for the supply of Inertial Navigation Ring Laser Gyro units supporting the AN/WSN-7 Combat System. The contract spans one year with no additional options and requires all work to be completed in Minneapolis by April 2024. The total contract amount of $12,045,229 will be funded through annual working capital funds (Navy) at the time of the award, and these funds will remain available beyond the current fiscal year. The contract was issued as a sole-source requirement under authority 10 U.S. Code 3204 (a)(1), with one company solicited and one offer received. Naval Supply Systems Command Weapon Systems Support, based in Mechanicsburg, Pennsylvania, is overseeing the contracting activity (N00104-23-D-GT01). The award was made on May 23, 2023.

Thales has been awarded a contract by Embraer Defence and Security to supply the Inertial Navigation System (INS) and GPS for the KC-390 military transport aircraft. Thales's High Performance Inertial Reference System (HPIRS) is a groundbreaking development in inertial navigation, offering the benefits of a certified civilian product with the performance levels required by military aircraft. This innovative system provides exceptional navigational capabilities, enabling military aircraft to perform missions in all weather conditions with the utmost safety. Additionally, the aircraft's navigation system features a unique architecture that significantly reduces life cycle and maintenance costs, making it suitable for installation on a wide range of civil and military aircraft.

Table of Contents

Defense Intertial Navigation System Market Report Definition

Defense Intertial Navigation System Market Segmentation

By Platform

By Region

By End User

Defense Intertial Navigation System Market Analysis for next 10 Years

The 10-year Defense Intertial Navigation System Market analysis would give a detailed overview of Defense Intertial Navigation System Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Intertial Navigation System Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Intertial Navigation System Market Forecast

The 10-year defense intertial navigation system market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Intertial Navigation System Market Trends & Forecast

The regional defense intertial navigation system market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Intertial Navigation System Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Intertial Navigation System Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Intertial Navigation System Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By End User, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By End User, 2024-2034

List of Figures

- Figure 1: Global Defense Inertial Navigation System Market Forecast, 2024-2034

- Figure 2: Global Defense Inertial Navigation System Market Forecast, By Region, 2024-2034

- Figure 3: Global Defense Inertial Navigation System Market Forecast, By Platform, 2024-2034

- Figure 4: Global Defense Inertial Navigation System Market Forecast, By End User, 2024-2034

- Figure 5: North America, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 6: Europe, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 8: APAC, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 9: South America, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 10: United States, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 11: United States, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 12: Canada, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 14: Italy, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 16: France, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 17: France, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 18: Germany, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 24: Spain, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 30: Australia, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 32: India, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 33: India, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 34: China, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 35: China, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 40: Japan, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Defense Inertial Navigation System Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Defense Inertial Navigation System Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Defense Inertial Navigation System Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Defense Inertial Navigation System Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Defense Inertial Navigation System Market, By Platform (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Defense Inertial Navigation System Market, By Platform (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Defense Inertial Navigation System Market, By End User (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Defense Inertial Navigation System Market, By End User (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Defense Inertial Navigation System Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Defense Inertial Navigation System Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Defense Inertial Navigation System Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Defense Inertial Navigation System Market, By Region, 2024-2034

- Figure 58: Scenario 1, Defense Inertial Navigation System Market, By Platform, 2024-2034

- Figure 59: Scenario 1, Defense Inertial Navigation System Market, By End User, 2024-2034

- Figure 60: Scenario 2, Defense Inertial Navigation System Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Defense Inertial Navigation System Market, By Region, 2024-2034

- Figure 62: Scenario 2, Defense Inertial Navigation System Market, By Platform, 2024-2034

- Figure 63: Scenario 2, Defense Inertial Navigation System Market, By End User, 2024-2034

- Figure 64: Company Benchmark, Defense Inertial Navigation System Market, 2024-2034