PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1838161

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1838161

Global Mine Countermeasure Ships Market 2025-2035

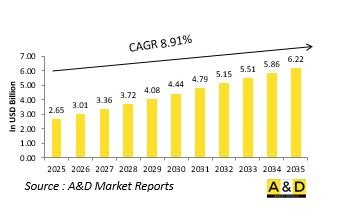

The Global Mine Countermeasure Ships market is estimated at USD 2.65 billion in 2025, projected to grow to USD 6.22 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.91% over the forecast period 2025-2035.

Introduction to Mine Countermeasure Ships Market:

The defense mine countermeasure ships market plays a vital role in ensuring maritime safety, freedom of navigation, and naval operational security. These specialized vessels are designed to detect, classify, and neutralize naval mines that pose significant threats to both military and commercial shipping routes. Mine countermeasure ships (MCMs) serve as critical assets in protecting strategic sea lanes, coastal infrastructure, and amphibious operations. Their ability to operate in shallow or contested waters makes them indispensable for modern naval forces tasked with maintaining maritime dominance. Over the years, the market has evolved from traditional minehunters and minesweepers to highly advanced, multi-role platforms capable of integrating unmanned underwater vehicles, sonar systems, and automated mine clearance technologies. These ships combine stealth, precision, and endurance, ensuring that naval forces can conduct operations safely in mine-infested environments. As maritime threats diversify, demand for efficient and modular mine countermeasure ships continues to grow, driven by the need for greater adaptability, endurance, and reduced human risk. The market's development reflects the broader trend toward integrated, technology-driven naval capabilities designed to safeguard global trade routes and maintain naval superiority in both peacetime operations and combat scenarios.

Technology Impact in Mine Countermeasure Ships Market:

Technological innovation is revolutionizing the defense mine countermeasure ships market, enabling fleets to perform complex missions with higher accuracy and reduced risk to personnel. Modern MCM vessels now incorporate advanced sonar arrays, synthetic aperture imaging, and automated target recognition systems that significantly enhance underwater detection capabilities. The integration of unmanned surface and underwater vehicles has transformed mine countermeasures into networked operations, allowing for remote identification and disposal of threats while minimizing exposure to danger. Lightweight composite hulls, magnetic signature reduction technologies, and advanced propulsion systems have improved maneuverability and stealth, enabling ships to operate effectively in high-risk zones. Artificial intelligence and machine learning algorithms are increasingly used to analyze sonar data, improving detection accuracy and decision-making speed. Additionally, modular mission systems allow for flexible configuration, enabling vessels to transition quickly between minehunting, surveillance, and escort duties. The convergence of digital command systems and real-time data sharing enhances situational awareness, allowing naval forces to coordinate more efficiently across platforms. Future advancements in autonomous operation, energy efficiency, and underwater communication technologies will continue to reshape mine countermeasure operations, establishing these vessels as vital enablers of maritime safety and strategic naval dominance in modern and future theaters of conflict

Key Drivers in Mine Countermeasure Ships Market:

The defense mine countermeasure ships market is driven by the rising complexity of naval threats and the need to secure strategic maritime corridors against potential disruptions. Naval mines remain among the most cost-effective yet destructive weapons, capable of denying access to ports and sea lanes. This persistent threat has pushed nations to invest heavily in advanced mine countermeasure capabilities that ensure safe navigation for both military and commercial fleets. Increasing geopolitical tensions, regional disputes, and expanding naval exercises have further emphasized the necessity for efficient mine detection and clearance systems. Modernization of aging fleets is another major driver, as countries replace traditional minesweepers with state-of-the-art MCM vessels that integrate digital navigation, sonar imaging, and unmanned systems. The growing focus on littoral and expeditionary warfare operations also reinforces the demand for agile ships capable of operating in shallow and confined waters. Defense organizations are prioritizing modularity and automation to improve flexibility, reduce crew requirements, and enhance mission endurance. Additionally, joint maritime operations and alliance-based naval collaborations are driving standardization and interoperability among mine countermeasure fleets. These factors collectively sustain steady market growth, underscoring the indispensable role of MCM ships in protecting maritime security and supporting global naval readiness.

Regional Trends in Mine Countermeasure Ships Market:

Regional trends in the defense mine countermeasure ships market reflect diverse naval priorities and threat perceptions shaped by geography and strategic interests. Maritime nations with extensive coastlines and heavily trafficked sea routes are prioritizing the development and deployment of advanced MCM fleets to safeguard economic and defense-critical waters. Regions prone to geopolitical tensions and contested maritime boundaries are accelerating procurement to ensure uninterrupted access to naval and commercial ports. Advanced naval powers are focusing on integrating unmanned technologies and networked systems into their MCM operations, enabling higher precision and reduced operational risk. In contrast, emerging defense markets are opting for cost-effective, modular vessels that balance performance with affordability while supporting domestic shipbuilding industries. Collaborative programs between allied nations are becoming more prominent, promoting technology transfer and joint training to enhance interoperability and readiness. Additionally, regional modernization initiatives are influenced by the rise in asymmetric threats such as underwater mines deployed by non-state actors. Coastal defense modernization and investment in autonomous minehunting systems are further shaping procurement patterns. Overall, regional dynamics demonstrate a global shift toward technologically advanced, flexible, and resilient mine countermeasure ships designed to meet the evolving challenges of contemporary maritime security operations.

Key Mine Countermeasure Ships Program:

The U.S. Navy has recently awarded multiple contracts under the Program Executive Office, Unmanned and Small Combatants (PEO USC) to support Littoral Combat Ship (LCS) Mine Countermeasures (MCM) Mission Package (MP) operations. The MCM Unmanned Surface Vehicle (USV) is a diesel-powered, unmanned surface craft that can be deployed from an LCS, a vessel of opportunity, or from shore. Its modular design allows it to carry a variety of payload systems for mine countermeasure tasks, including minesweeping, mine hunting, and mine neutralization. These contracts aim to ensure the Navy has cutting-edge unmanned systems capable of effectively executing MCM missions in littoral waters. The first contract, valued at $7.7 million, was awarded to Bollinger Shipyards for an MCM USV Advanced Material Order (AMO), scheduled for completion in September 2025. This procurement focuses on components to enhance the USV based on operational testing feedback. Raytheon Technologies received an $18.3 million production contract for the Minehunt Payload Delivery System (MH PDS) to manufacture five units, with deliveries expected by the end of FY26. Textron Systems was awarded a $12.1 million production contract for the Minesweep Payload Delivery System (MS PDS) to produce four units, scheduled for delivery in early FY27.

Table of Contents

Mine Countermeasure Ships Market Report Definition

Mine Countermeasure Ships Market Segmentation

By Region

By Technique

By Application

Mine Countermeasure Ships Market Analysis for next 10 Years

The 10-year Mine Countermeasure Ships Market analysis would give a detailed overview of Mine Countermeasure Ships Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Mine Countermeasure Ships Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Mine Countermeasure Ships Market Forecast

The 10-year Mine Countermeasure Ships Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Mine Countermeasure Ships Market Trends & Forecast

The regional Mine Countermeasure Ships Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Mine Countermeasure Ships Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Mine Countermeasure Ships Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Mine Countermeasure Ships Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Technique, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Technique, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Mine Counter measure Ships Market Forecast, 2025-2035

- Figure 2: Global Mine Counter measure Ships Market Forecast, By Region, 2025-2035

- Figure 3: Global Mine Counter measure Ships Market Forecast, By Technique, 2025-2035

- Figure 4: Global Mine Counter measure Ships Market Forecast, By Application, 2025-2035

- Figure 5: North America, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 6: Europe, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 8: APAC, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 9: South America, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 10: United States, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 11: United States, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 12: Canada, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 14: Italy, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 16: France, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 17: France, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 18: Germany, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 24: Spain, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 30: Australia, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 32: India, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 33: India, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 34: China, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 35: China, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 40: Japan, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Mine Counter measure Ships Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Mine Counter measure Ships Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Mine Counter measure Ships Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Mine Counter measure Ships Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Mine Counter measure Ships Market, By Technique (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Mine Counter measure Ships Market, By Technique (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Mine Counter measure Ships Market, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Mine Counter measure Ships Market, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Mine Counter measure Ships Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Mine Counter measure Ships Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Mine Counter measure Ships Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Mine Counter measure Ships Market, By Region, 2025-2035

- Figure 58: Scenario 1, Mine Counter measure Ships Market, By Technique, 2025-2035

- Figure 59: Scenario 1, Mine Counter measure Ships Market, By Application, 2025-2035

- Figure 60: Scenario 2, Mine Counter measure Ships Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Mine Counter measure Ships Market, By Region, 2025-2035

- Figure 62: Scenario 2, Mine Counter measure Ships Market, By Technique, 2025-2035

- Figure 63: Scenario 2, Mine Counter measure Ships Market, By Application, 2025-2035

- Figure 64: Company Benchmark, Mine Counter measure Ships Market, 2025-2035