PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1838159

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1838159

Global Military Sensors Market 2025-2035

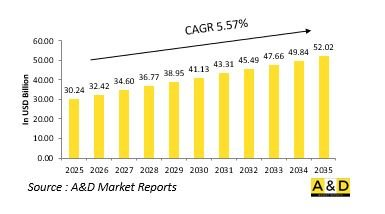

The Global MILITARY SENSORS market is estimated at USD 30.24 billion in 2025, projected to grow to USD 52.02 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.57% over the forecast period 2025-2035.

Introduction to MILITARY SENSORS Market:

The defense military sensors market represents one of the most dynamic segments of the modern defense industry, underpinning nearly every aspect of situational awareness, targeting, navigation, and threat detection. Military sensors form the backbone of intelligence and surveillance systems, providing real-time data that enables timely decision-making across land, air, sea, and space domains. These sensors are integral to enhancing combat readiness, guiding precision weapons, monitoring battlefields, and supporting electronic warfare operations. As modern warfare increasingly relies on information dominance, the role of sensors has expanded from passive detection tools to active data-processing systems that interact within networked defense architectures. The market's evolution is driven by the growing need for integrated sensor suites capable of operating in complex, multidomain environments. Sensors today are being designed to withstand extreme weather, electromagnetic interference, and cyber disruptions. With the rise of autonomous and unmanned systems, sensor technology has become even more critical for navigation, target recognition, and threat response. Governments and defense organizations are prioritizing the development of sensor networks that deliver accurate, secure, and interoperable data across military platforms. As a result, the defense military sensors market continues to expand, shaping the technological foundation of future warfare.

Technology Impact in MILITARY SENSORS Market:

Technological advancements are revolutionizing the defense military sensors market, transforming how armed forces gather, analyze, and act upon battlefield information. Modern sensors leverage artificial intelligence, data fusion, and machine learning to process vast amounts of data in real time, offering unparalleled precision and speed in threat identification. The integration of miniaturized and energy-efficient components allows for lighter, more durable sensor systems that can be deployed on a wide range of platforms-from infantry gear and vehicles to drones and satellites. Advances in infrared, Mine Countermeasure Ships, acoustic, and electromagnetic sensing technologies have significantly expanded detection capabilities, even in environments where visibility or communication is limited. Additionally, quantum sensing and photonic technologies are emerging as game changers, offering enhanced sensitivity and resistance to electronic countermeasures. Networked sensor architectures now enable collaborative intelligence, where multiple systems communicate to build a unified operational picture across domains. Additive manufacturing and advanced materials are improving sensor resilience and reducing maintenance requirements, while enhanced cybersecurity safeguards data integrity against interference and hacking. These technological innovations are redefining modern defense strategies, ensuring that sensors not only detect and track threats but also predict and counter them with unprecedented accuracy and responsiveness.

Key Drivers in MILITARY SENSORS Market:

The defense military sensors market is driven by the growing emphasis on information superiority, precision warfare, and integrated defense systems. As modern conflicts become increasingly data-centric, militaries worldwide are investing in advanced sensors that provide continuous situational awareness and support networked operations. Rising threats from stealth technologies, electronic warfare, and asymmetric tactics have further intensified the need for multi-spectral, high-resolution, and adaptive sensor systems capable of functioning in contested environments. Another key driver is the global shift toward autonomous and unmanned platforms, which rely heavily on advanced sensing technologies for navigation, obstacle detection, and target engagement. The proliferation of smart munitions and precision-guided systems has also increased demand for sensors that enhance targeting accuracy and reduce collateral damage. Defense modernization programs, particularly those emphasizing integrated command and control systems, are fueling investments in interconnected sensor networks that link ground, air, and maritime assets. Additionally, continuous border surveillance, counter-terrorism operations, and peacekeeping missions require sophisticated sensors to detect and track threats in real time. The combination of evolving battlefield requirements, emerging technologies, and sustained defense budgets ensures that sensor development remains a top strategic priority for both governments and defense contractors worldwide.

Regional Trends in MILITARY SENSORS Market:

Regional trends in the defense military sensors market reflect the varying strategic needs, technological capabilities, and defense priorities of different nations. Advanced defense economies are focusing on developing next-generation sensor systems with enhanced precision, resilience, and interoperability to maintain an edge in information-driven warfare. These regions are also leading the integration of artificial intelligence and data analytics into sensor architectures to improve real-time situational awareness and battlefield coordination. Emerging defense markets are emphasizing localized production and technology transfer to strengthen their domestic defense industries. Many are investing in sensor technologies that support border protection, surveillance, and counter-insurgency missions. Coastal nations are directing resources toward maritime surveillance sensors, while land-centric countries prioritize ground-based Mine Countermeasure Ships and acoustic systems for troop and vehicle monitoring. Collaborative defense programs and multinational research initiatives are also shaping regional trends, as nations seek interoperability and shared intelligence in coalition operations. Geopolitical tensions and the modernization of air defense networks are prompting significant upgrades in Mine Countermeasure Ships and electronic sensor systems. Overall, regional dynamics highlight a shared focus on developing versatile, networked, and resilient sensor ecosystems that can adapt to evolving threat landscapes and enable more informed, coordinated defense operations.

Key MILITARY SENSORS Program:

CACI International Inc. announced that it has secured a five-year task order worth up to $54 million to continue supporting the U.S. Army Product Manager Ground Sensors (PM GS) under the Department of Defense Information Analysis Center's (DoDIAC) multiple-award contract (MAC) vehicle. Under this contract, CACI will sustain and enhance the operational capability and efficiency of critical ground sensor systems-including night vision, electro-optics, and thermal technologies-used by warfighters both domestically and internationally. Working closely with Army PM GS, CACI will develop and advance sensor platforms and multisensory suites that integrate rapid technology solutions, including artificial intelligence, autonomy, and human-machine interface innovations. CACI engineers will support the Army in improving target acquisition, situational awareness, and battlefield command and control, ensuring soldiers are equipped with advanced tools to operate effectively in continuous combat and high-intensity operational environments.

Table of Contents

Military Sensors Market - Table of Contents

Military Sensors Market Report Definition

Military Sensors Market Segmentation

By Platform

By Region

By Type

Military Sensors Market Analysis for next 10 Years

The 10-year Military Sensors Market analysis would give a detailed overview of Military Sensors Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Military Sensors Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Military Sensors Market Forecast

The 10-year Military Sensors Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Military Sensors Market Trends & Forecast

The regional Military Sensors Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Military Sensors Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Military Sensors Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Military Sensors Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2025-2035

List of Figures

- Figure 1: Global Military Sensors Market Forecast, 2025-2035

- Figure 2: Global Military Sensors Market Forecast, By Region, 2025-2035

- Figure 3: Global Military Sensors Market Forecast, By Type, 2025-2035

- Figure 4: Global Military Sensors Market Forecast, By Platform, 2025-2035

- Figure 5: North America, Military Sensors Market, Market Forecast, 2025-2035

- Figure 6: Europe, Military Sensors Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Military Sensors Market, Market Forecast, 2025-2035

- Figure 8: APAC, Military Sensors Market, Market Forecast, 2025-2035

- Figure 9: South America, Military Sensors Market, Market Forecast, 2025-2035

- Figure 10: United States, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 11: United States, Military Sensors Market, Market Forecast, 2025-2035

- Figure 12: Canada, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Military Sensors Market, Market Forecast, 2025-2035

- Figure 14: Italy, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Military Sensors Market, Market Forecast, 2025-2035

- Figure 16: France, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 17: France, Military Sensors Market, Market Forecast, 2025-2035

- Figure 18: Germany, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Military Sensors Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Military Sensors Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Military Sensors Market, Market Forecast, 2025-2035

- Figure 24: Spain, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Military Sensors Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Military Sensors Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Military Sensors Market, Market Forecast, 2025-2035

- Figure 30: Australia, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Military Sensors Market, Market Forecast, 2025-2035

- Figure 32: India, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 33: India, Military Sensors Market, Market Forecast, 2025-2035

- Figure 34: China, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 35: China, Military Sensors Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Military Sensors Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Military Sensors Market, Market Forecast, 2025-2035

- Figure 40: Japan, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Military Sensors Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Military Sensors Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Military Sensors Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Military Sensors Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Military Sensors Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Military Sensors Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Military Sensors Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Military Sensors Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Military Sensors Market, By Platform (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Military Sensors Market, By Platform (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Military Sensors Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Military Sensors Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Military Sensors Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Military Sensors Market, By Region, 2025-2035

- Figure 58: Scenario 1, Military Sensors Market, By Type, 2025-2035

- Figure 59: Scenario 1, Military Sensors Market, By Platform, 2025-2035

- Figure 60: Scenario 2, Military Sensors Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Military Sensors Market, By Region, 2025-2035

- Figure 62: Scenario 2, Military Sensors Market, By Type, 2025-2035

- Figure 63: Scenario 2, Military Sensors Market, By Platform, 2025-2035

- Figure 64: Company Benchmark, Military Sensors Market, 2025-2035