PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1838162

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1838162

Global Mine Detection Market 2025-2035

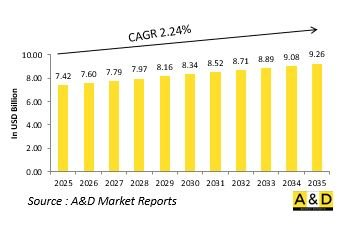

The Global Mine Detection market is estimated at USD 7.42 billion in 2025, projected to grow to USD 9.26 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 2.24% over the forecast period 2025-2035.

Introduction to Mine Detection Market

The defense mine detection market is a critical component of modern military operations, focusing on identifying and neutralizing hidden explosive threats across land and maritime environments. These systems are essential for ensuring the safety of personnel, vehicles, and infrastructure in both combat and peacekeeping missions. Mine detection technologies are used extensively during battlefield clearance, border security, and post-conflict recovery to mitigate the risks posed by landmines, improvised explosive devices, and naval mines. The market encompasses a wide range of equipment, including handheld detectors, ground-penetrating radars, unmanned vehicles, and airborne sensors designed to locate mines in diverse terrains. As military operations increasingly shift toward asymmetric and hybrid warfare, the importance of mine detection capabilities continues to grow. Armed forces rely on rapid and precise detection tools to maintain mobility and prevent casualties during maneuvers. Modern mine detection systems combine advanced sensing, imaging, and data-processing technologies to provide accurate results in real time. The market's expansion is also driven by humanitarian initiatives aimed at demining regions affected by prolonged conflicts. With safety and efficiency as top priorities, the defense mine detection market remains indispensable to ensuring operational effectiveness and restoring stability in post-conflict and contested environments.

Technology Impact in Mine Detection Market:

Technological innovation is reshaping the defense mine detection market by enhancing accuracy, speed, and operator safety. Traditional manual detection methods are being replaced or supplemented by sophisticated systems that integrate advanced sensors, artificial intelligence, and automation. Ground-penetrating radar, electromagnetic induction, and chemical sensors are being refined to detect both metallic and non-metallic explosive devices concealed in complex environments. These technologies provide high-resolution imaging that allows forces to identify the type, depth, and shape of buried mines with greater reliability. Autonomous ground and aerial platforms are revolutionizing detection operations by performing reconnaissance and mapping in hazardous zones without direct human involvement. The integration of machine learning algorithms enables adaptive detection that improves over time, minimizing false alarms and optimizing mission efficiency. Data fusion technologies combine inputs from multiple sensors, creating a comprehensive understanding of the threat landscape. Moreover, lightweight and ruggedized materials are enhancing portability and durability for field operations. The convergence of digital communication networks and real-time data transmission ensures faster decision-making and improved coordination across units. As defense forces pursue greater precision and safety, these technological advances are transforming mine detection from a labor-intensive task into a highly automated, intelligence-driven capability critical for modern military missions.

Key Drivers in Mine Detection Market:

The defense mine detection market is driven by the persistent threat of explosive hazards that endanger military mobility and humanitarian operations. Increasing use of landmines and improvised explosive devices in conflict zones has underscored the need for advanced detection capabilities to protect soldiers and civilians alike. Governments and defense organizations are prioritizing investments in modern detection systems that offer higher accuracy, faster response times, and the ability to function in diverse environmental conditions. Ongoing military modernization and counter-insurgency efforts have further accelerated the adoption of cutting-edge detection technologies. The growing prevalence of hybrid warfare, where hidden explosives are used to disrupt logistics and restrict movement, reinforces the demand for portable, autonomous, and unmanned detection platforms. Humanitarian demining initiatives supported by international collaborations also contribute significantly to market growth, as nations work toward restoring safe access to war-affected regions. Another key driver is the integration of artificial intelligence and sensor fusion into mine detection operations, enabling automated identification and mapping of threats. These advancements align with the broader military objective of enhancing operational safety, reducing risk exposure, and maintaining tactical advantage. Collectively, these factors ensure sustained demand and innovation within the defense mine detection market.

Regional Trends in Mine Detection Market:

Regional trends in the defense mine detection market are shaped by varying levels of conflict exposure, terrain challenges, and modernization priorities. Regions affected by past or ongoing conflicts continue to invest heavily in demining operations to restore safety and enable reconstruction. Military modernization programs across diverse geographies are driving demand for integrated mine detection systems capable of addressing both traditional and improvised explosive threats. In technologically advanced regions, defense agencies are focusing on developing and deploying next-generation detection platforms that combine automation, robotics, and AI-powered data analytics to achieve faster and more accurate results. Meanwhile, emerging defense markets are adopting cost-effective yet reliable systems to address border security and counter-insurgency requirements. Collaborative defense programs and international partnerships are promoting technology transfer and shared training to enhance regional capabilities. Maritime regions are expanding focus on underwater mine detection to protect naval routes and coastal infrastructure, integrating sonar and unmanned underwater vehicles for deep-sea surveillance. Landlocked nations, on the other hand, emphasize ground-based and vehicle-mounted systems for tactical field operations. Overall, regional dynamics highlight a global movement toward adopting advanced, adaptable, and interoperable mine detection technologies that ensure safety, mobility, and mission continuity in complex security environments.

Key Mine Detection Program:

Northrop Grumman Corporation (NYSE: NOC) has been awarded a contract by Korea Aerospace Industries, Ltd. (KAI) to supply Airborne Laser Mine Detection System (ALMDS) solutions and provide technical support during the Engineering, Manufacturing, and Design (EMD) phase of the Republic of Korea's Korean Mine Countermeasures Helicopter (KMCH) program. The EMD phase is scheduled for completion in 2027. The ALMDS enables untethered operations both day and night, achieving high-area search rates for efficient mine detection. In addition, it delivers precise target geo-location data to facilitate the subsequent neutralization of identified mines, enhancing the overall effectiveness of mine countermeasure operations.

.

Table of Contents

Mine Detection Market Report - Table of Contents

Mine Detection Market Report Definition

Mine Detection Market Segmentation

By Region

By Platform

By Type

Mine Detection Market Analysis for next 10 Years

The 10-year Mine Detection Market analysis would give a detailed overview of Mine Detection Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Mine Detection Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Mine Detection Market Forecast

The 10-year Mine Detection Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Mine Detection Market Trends & Forecast

The regional Mine Detection Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Mine Detection Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Mine Detection Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Mine Detection Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Mine Detection Market Forecast, 2025-2035

- Figure 2: Global Mine Detection Market Forecast, By Region, 2025-2035

- Figure 3: Global Mine Detection Market Forecast, By Platform, 2025-2035

- Figure 4: Global Mine Detection Market Forecast, By Type, 2025-2035

- Figure 5: North America, Mine Detection Market, Market Forecast, 2025-2035

- Figure 6: Europe, Mine Detection Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Mine Detection Market, Market Forecast, 2025-2035

- Figure 8: APAC, Mine Detection Market, Market Forecast, 2025-2035

- Figure 9: South America, Mine Detection Market, Market Forecast, 2025-2035

- Figure 10: United States, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 11: United States, Mine Detection Market, Market Forecast, 2025-2035

- Figure 12: Canada, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Mine Detection Market, Market Forecast, 2025-2035

- Figure 14: Italy, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Mine Detection Market, Market Forecast, 2025-2035

- Figure 16: France, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 17: France, Mine Detection Market, Market Forecast, 2025-2035

- Figure 18: Germany, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Mine Detection Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Mine Detection Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Mine Detection Market, Market Forecast, 2025-2035

- Figure 24: Spain, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Mine Detection Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Mine Detection Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Mine Detection Market, Market Forecast, 2025-2035

- Figure 30: Australia, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Mine Detection Market, Market Forecast, 2025-2035

- Figure 32: India, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 33: India, Mine Detection Market, Market Forecast, 2025-2035

- Figure 34: China, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 35: China, Mine Detection Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Mine Detection Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Mine Detection Market, Market Forecast, 2025-2035

- Figure 40: Japan, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Mine Detection Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Mine Detection Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Mine Detection Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Mine Detection Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Mine Detection Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Mine Detection Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Mine Detection Market, By Platform (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Mine Detection Market, By Platform (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Mine Detection Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Mine Detection Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Mine Detection Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Mine Detection Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Mine Detection Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Mine Detection Market, By Region, 2025-2035

- Figure 58: Scenario 1, Mine Detection Market, By Platform, 2025-2035

- Figure 59: Scenario 1, Mine Detection Market, By Type, 2025-2035

- Figure 60: Scenario 2, Mine Detection Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Mine Detection Market, By Region, 2025-2035

- Figure 62: Scenario 2, Mine Detection Market, By Platform, 2025-2035

- Figure 63: Scenario 2, Mine Detection Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Mine Detection Market, 2025-2035