PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1904999

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1904999

Global Defense Heads Up Display Market 2026-2036

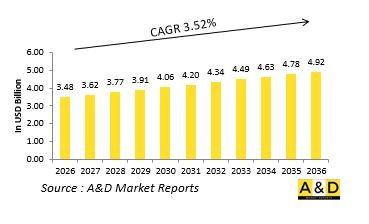

The Global Defense Heads Up Display market is estimated at USD 3.48 billion in 2026, projected to grow to USD 4.92 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 3.52% over the forecast period 2026-2036.

Introduction to Defense Heads Up Display Market

The Global Defense Heads Up Display (HUD) Market encompasses systems that project critical flight, navigation, targeting, and sensor information into the operator's forward field of view, allowing simultaneous monitoring of instruments and the external environment. Originally developed for fighter aircraft to enable pilots to keep their eyes "out of the cockpit" during critical phases of flight, HUD technology has expanded to helicopters, ground vehicles, and even dismounted soldier systems. Modern HUDs integrate symbols, cues, and sensor imagery that appear to float in space ahead of the operator, providing situationally referenced information that enhances spatial orientation, reduces workload, and decreases reaction time. As military operations increase in tempo and complexity, and as platforms operate in more cluttered environments, the ability to access information without looking away from the operational scene has transitioned from tactical advantage to operational necessity across multiple domains.

Technology Impact in Defense Heads Up Display Market:

Technological advancement in HUD systems focuses on display quality, information integration, and form factor evolution. Digital light processing and laser scanning projection systems enable brighter, higher-contrast imagery visible in all lighting conditions, including direct sunlight. Augmented reality capabilities overlay synthetic terrain, obstacle warnings, and target designations directly onto the real-world view. Integration with helmet-mounted systems creates distributed display architectures where information migrates between head-up and head-down locations based on context. Miniaturization enables HUD installation in vehicles and aircraft with limited cockpit space. Advanced symbology systems use color, intensity, and motion to convey information urgency and priority intuitively. Wireless connectivity allows seamless information sharing between platforms and dismounted personnel. These innovations transform HUDs from simple flight instrument repeaters into comprehensive situational awareness tools that fuse platform, sensor, and network data into actionable visual presentations.

Key Drivers in Defense Heads Up Display Market:

The increasing complexity of information management in modern military platforms creates cognitive overload challenges that HUDs specifically address by presenting prioritized data in the operator's natural field of view. Reduced crew size initiatives across aircraft and vehicle platforms necessitate more efficient information presentation to maintain effectiveness with fewer personnel. Low-visibility operations-whether from weather, darkness, or battlefield obscurants-require enhanced situational awareness tools that HUDs provide through synthetic vision and sensor overlay capabilities. Network-centric warfare implementation enables off-board sensor data to be displayed on HUDs, extending situational awareness beyond organic sensors. Safety enhancement mandates favor systems that improve spatial orientation and obstacle awareness, particularly during demanding operational phases. Additionally, technology transfer from automotive and gaming industries accelerates capability advancement while presenting challenges in meeting military environmental and security standards.

Regional Trends in Defense Heads Up Display Market:

Regional HUD development reflects differing platform modernization strategies and industrial capabilities. North American programs emphasize integration with helmet-mounted systems and network data feeds, particularly for next-generation combat aircraft. European development focuses on multi-role systems applicable across fixed-wing, rotary-wing, and ground vehicle applications within multinational programs. The Asia-Pacific region shows strong growth tied to indigenous fighter and helicopter programs, with increasing emphasis on local design and manufacturing. Israeli innovation excels in compact systems for upgraded legacy platforms and specialized applications. Middle Eastern procurement often accompanies Western platform acquisitions, with increasing demand for technology transfer and localized support. Commercial technology convergence presents both opportunities and challenges, with automotive HUD advancements influencing military systems while raising concerns about security vulnerabilities in commercial-derived components. Training system requirements further drive HUD adoption, as simulated displays must replicate operational systems for effective skill transfer.

Key Defense Heads Up Display Program:

The Augmented Reality Head Mounted Display (ARHMD) system has been conceptualized as a capability enhancer for land-based air defence weapon platforms, including the IGLA shoulder-launched infrared homing missile system and the ZU-23 mm 2B air defence gun. The system is designed to present radar and thermal imaging sensor data directly within the operator's field of view through augmented overlays. By fusing multiple sensor inputs, the ARHMD aims to improve target detection, tracking, and engagement effectiveness, particularly during night operations and adverse weather conditions. Daytime engagements are also expected to benefit through faster reaction times, enhanced situational awareness, and decision-support features enabled by real-time data processing and thermal imagery integration. To acquire this advanced capability, the Indian Army has initiated procurement of 556 ARHMD systems under the Make-II category. Following a detailed assessment of industry responses, Project Sanction Orders were issued on 22 February 2021 to six vendors for prototype development. Upon successful completion and evaluation of the prototypes, a production contract will be awarded to one of the firms under the Buy (Indian-IDDM) category in accordance with the Defence Acquisition Procedure 2020. The development of the ARHMD system under the Make-II framework is expected to significantly enhance air defence operations while supporting the Government of India's Atmanirbhar Bharat initiative by strengthening indigenous defence technology and industrial self-reliance.

Table of Contents

Heads Up Display Market Report Definition

Heads Up Display Market Segmentation

By Type

By Region

By End user

Heads Up Display Market Analysis for next 10 Years

The 10-year heads up display market analysis would give a detailed overview of heads up display market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Heads Up Display Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Heads Up Display Market Forecast

The 10-year heads up display market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Heads Up Display Market Trends & Forecast

The regional heads up display market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Heads Up Display Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Heads Up Display Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Heads Up Display Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By End User, 2025-2035

List of Figures

- Figure 1: Global Defense Heads Up Display Market Forecast, 2025-2035

- Figure 2: Global Defense Heads Up Display Market Forecast, By Region, 2025-2035

- Figure 3: Global Defense Heads Up Display Market Forecast, By Type, 2025-2035

- Figure 4: Global Defense Heads Up Display Market Forecast, By End User, 2025-2035

- Figure 5: North America, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 9: South America, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 10: United States, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 16: France, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 17: France, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 20: Netherland, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 21: Netherland, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 32: India, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 33: India, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 34: China, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 35: China, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Heads Up Display Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Heads Up Display Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Heads Up Display Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Heads Up Display Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Heads Up Display Market, By End User (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Heads Up Display Market, By End User (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Heads Up Display Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Heads Up Display Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Heads Up Display Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Heads Up Display Market, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Heads Up Display Market, By Type, 2025-2035

- Figure 59: Scenario 1, Defense Heads Up Display Market, By End User, 2025-2035

- Figure 60: Scenario 2, Defense Heads Up Display Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Heads Up Display Market, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Heads Up Display Market, By Type, 2025-2035

- Figure 63: Scenario 2, Defense Heads Up Display Market, By End User, 2025-2035

- Figure 64: Company Benchmark, Defense Heads Up Display Market, 2025-2035