PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1508614

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1508614

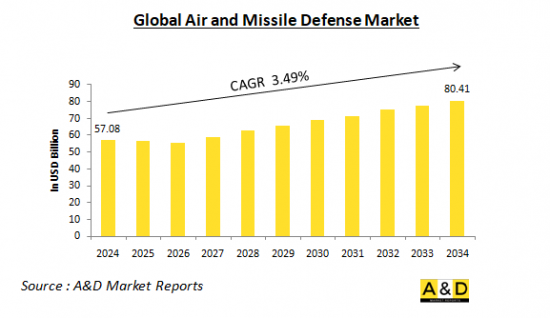

Global Air and Missile Defense Market 2024-2034

The global Air and Missile Defense market is estimated at USD 57.08 billion in 2024, projected to grow to USD 80.41 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 3.49% over the forecast period 2024-2034

Introduction to Air and Missile Defense Market

The air and missile defense market refers to the global industry involved in the design, development, production, and maintenance of systems that protect against airborne threats such as aircraft, missiles, and drones. These systems utilize a combination of radars, interceptors, command and control, and other technologies to detect, track, and neutralize incoming threats. The demand for advanced, integrated air defense capabilities is a major trend driving market growth.

Technology Impact in Air and Missile Defense Market

Technological advancements are a key factor shaping the air and missile defense market. Innovations in radar, sensor, and data processing technologies are enabling more capable and integrated air defense systems. Some key technological impacts include radar advancements, such as the shift from single-band to dual-band radars, providing enhanced detection and tracking capabilities; the adoption of Active Electronically Scanned Array (AESA) radars for improved performance; and the development of Long Range Discrimination Radar (LRDR) systems with advanced target discrimination. Sensor integration advancements include the fusion of data from multiple sensors (radar, electro-optical, infrared) for comprehensive situational awareness and the integration of counter-UAS sensors to detect and neutralize small drone threats. Improvements in weapon systems, such as missile interceptor capabilities, including increased range, speed, and maneuverability, as well as the integration of directed energy weapons and electromagnetic weapons for non-kinetic defense, are also key technological impacts. Advancements in command and control, such as improvements in battle management and command & control systems for coordinated multi-domain operations and the adoption of network-centric warfare concepts for real-time data sharing and decision-making, are further enabling air defense systems to better detect, track, and engage a wider range of airborne threats, from aircraft and missiles to drones and hypersonic weapons.

Key Drivers in Air and Missile Defense Market

The global air and missile defense market is experiencing a surge, fueled by several key drivers. One significant factor is the rise in military spending across the globe, particularly in regions like the Asia-Pacific and the Middle East. These increased budgets translate to new procurement activities, with nations bolstering their air defense capabilities by acquiring advanced systems. Additionally, existing systems are undergoing upgrades to ensure they remain effective against evolving threats.

Modernization efforts play another crucial role in market growth. Countries are actively replacing their aging air defense equipment with more advanced and integrated systems. These newer systems offer greater capabilities, allowing them to address the ever-changing nature of aerial threats beyond 2030. This focus on modernization ensures that nations possess robust and up-to-date air defense solutions.

Geopolitical tensions around the world are also pushing the demand for stronger air defense systems. Heightened regional conflicts and rivalries, particularly in areas like the Taiwan Strait, Korean Peninsula, and the Middle East, necessitate robust air defense capabilities. Nations in these regions are prioritizing investments in air defense to deter potential attacks and protect their critical infrastructure.

The proliferation of aerial threats further drives market growth. The increasing number of advanced aircraft, missiles, and unmanned aerial systems (UAS) necessitates multi-layered air defense solutions. Countries require a combination of systems to effectively counter these diverse threats, leading to increased demand across the air and missile defense market.

Technological advancements are another key factor propelling market growth. Innovations in radar technology, sensors, interceptors, and command and control systems are enabling the development of more capable and effective air defense systems. These advancements allow for earlier threat detection, improved tracking capabilities, and more precise engagement, leading to a more robust defense posture.

Finally, a growing trend in the market is the focus on indigenous development. Many nations are prioritizing the domestic design and production of air and missile defense systems. This push for self-sufficiency aims to reduce reliance on imported systems and address the high costs associated with acquiring foreign platforms. By developing their own capabilities, nations can potentially control costs and tailor their air defense systems to their specific needs and threats.

Regional Trends in Air and Missile Defense Market

The global air and missile defense market showcases distinct regional trends, with each region exhibiting unique characteristics and priorities.

North America reigns supreme, driven by the immense military spending of the United States. Major players like Lockheed Martin, Raytheon, and Northrop Grumman are at the forefront of developing cutting-edge air and missile defense systems. Canada is also actively pursuing upgrades to its air defense capabilities, with the procurement of the Patriot missile defense system a prime example.

Europe presents a picture of collaboration. Countries like Germany, France, and the UK are pooling resources to develop next-generation air defense systems, such as the ambitious Future Combat Air System (FCAS). Eastern European nations, facing a heightened geopolitical climate, are bolstering their defenses through increased procurement of proven systems like the Patriot and IRIS-T.

The Asia-Pacific region is experiencing a boom, with China, India, Japan, and South Korea emerging as major markets. Indigenous development is a key focus in this region, with nations striving to build air defense systems tailored to address specific regional threats. India's Advanced Medium-Range Air-to-Air Missile (AMRAAM) and Long-Range Surface-to-Air Missile (LR-SAM) programs exemplify this trend. Australia and Japan are also actively modernizing their air defense capabilities, acquiring Aegis-equipped destroyers and Patriot missile systems.

The Middle East is a region grappling with ongoing conflicts and the constant threat of ballistic missiles and drones. Countries like Saudi Arabia, the United Arab Emirates, and Israel are investing heavily in air defense systems to counter these threats. Israel's Iron Dome and David's Sling systems have garnered global recognition for their effectiveness in intercepting short-range rockets and missiles.

Latin America, while a smaller player, has a noteworthy market in Brazil. Brazil is actively pursuing modernization efforts, with the acquisition of the SAMP/T missile defense system a key step in bolstering its air defense capabilities. This highlights the growing importance of air defense systems in various regions around the world.

Key Air and Missile Defense Program

Raytheon Technologies, a subsidiary of RTX, has been awarded a substantial $1.2 billion contract to supply Germany with the latest Patriot air and missile defense systems. The contract encompasses the most advanced Patriot Configuration 3+ radars, launchers, command and control stations, as well as necessary spare parts and support services.The Patriot system has become the foundation of air defense for 19 nations worldwide, including Germany, the United States, and Ukraine. Its formidable capabilities, proven in combat, continue to demonstrate the Patriot's effectiveness in countering the most sophisticated and complex threats. The system's proven track record and ongoing modernization ensure its ability to protect nations from evolving aerial threats. This major contract award highlights Germany's commitment to strengthening its air defense capabilities and the country's confidence in the Patriot system. It also underscores Raytheon's position as a leading provider of advanced air defense solutions to nations seeking to safeguard their airspace and populations from potential attacks.The Patriot's adaptability and continuous technological enhancements have made it a preferred choice for nations seeking to modernize their air defense infrastructure. As threats continue to evolve, the Patriot system remains at the forefront of air defense, providing a reliable and effective solution for protecting national interests.

The U.S. Army has awarded Lockheed Martin a multi-year contract valued at $4.5 billion for the procurement of its Patriot air defense missile system. This substantial contract covers the production of 870 PAC-3 MSE interceptor missiles and associated equipment.The Patriot system, which is being supplied by Western nations to Ukraine, is a key component of the country's defense against the ongoing Russian invasion. The PAC-3 MSE is the latest and most advanced version of the Patriot interceptor missiles, with each unit costing approximately $4 million according to U.S. Army budget documents.This multi-year contract underscores the U.S. Army's commitment to maintaining and modernizing its air defense capabilities. The Patriot system, with its ability to intercept a wide range of aerial threats, including ballistic missiles, cruise missiles, and aircraft, plays a crucial role in the Army's overall defense strategy.

Table of Contents

Air and Missile Defense Market Report Definition

Air and Missile Defense Market Segmentation

By Region

By Type

By End User

Air and Missile Defense Market Analysis for next 10 Years

The 10-year air and missile defense market analysis would give a detailed overview of air and missile defense market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Air and Missile Defense Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Air and Missile Defense Market Forecast

The 10-year air and missile defense market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Air and Missile Defense Market Trends & Forecast

The regional air and missile defense market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Air and Missile Defense Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Air and Missile Defense Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Air and Missile Defense Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Type, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By End User, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Type, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By End User, 2024-2034

List of Figures

- Figure 1: Global Air and Missile Defense Market Forecast, 2024-2034

- Figure 2: Global Air and Missile Defense Market Forecast, By Region, 2024-2034

- Figure 3: Global Air and Missile Defense Market Forecast, By Type, 2024-2034

- Figure 4: Global Air and Missile Defense Market Forecast, By End User, 2024-2034

- Figure 5: North America, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 6: Europe, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 8: APAC, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 9: South America, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 10: United States, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 11: United States, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 12: Canada, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 14: Italy, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 16: France, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 17: France, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 18: Germany, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 24: Spain, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 30: Australia, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 32: India, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 33: India, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 34: China, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 35: China, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 40: Japan, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Air and Missile Defense Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Air and Missile Defense Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Air and Missile Defense Market, By Type (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Air and Missile Defense Market, By Type (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Air and Missile Defense Market, By End User (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Air and Missile Defense Market, By End User (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Air and Missile Defense Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Air and Missile Defense Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Air and Missile Defense Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Air and Missile Defense Market, By Region, 2024-2034

- Figure 58: Scenario 1, Air and Missile Defense Market, By Type, 2024-2034

- Figure 59: Scenario 1, Air and Missile Defense Market, By End User, 2024-2034

- Figure 60: Scenario 2, Air and Missile Defense Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Air and Missile Defense Market, By Region, 2024-2034

- Figure 62: Scenario 2, Air and Missile Defense Market, By Type, 2024-2034

- Figure 63: Scenario 2, Air and Missile Defense Market, By End User, 2024-2034

- Figure 64: Company Benchmark, Air and Missile Defense Market, 2024-2034