PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1490825

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1490825

Global Electronic Warfare Aircraft Market 2024-2034

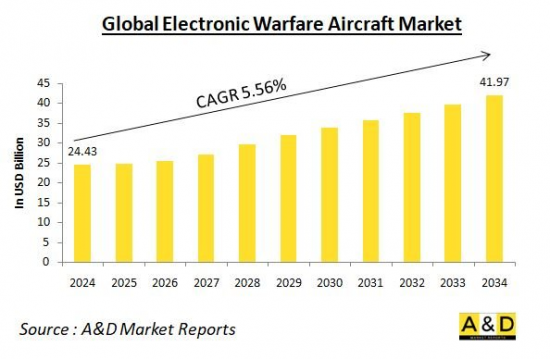

The global Electronic Warfare market is estimated at USD 24.43 billion in 2024, projected to grow to USD 41.97 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 5.56% over the forecast period 2024-2034.

Introduction to Electronic Warfare Aircraft

The global electronic warfare (EW) aircraft market is a critical segment of the defense industry, focused on developing and deploying aircraft equipped with advanced electronic systems designed to disrupt, deceive, and degrade enemy electronic capabilities. EW aircraft play a vital role in modern warfare by providing situational awareness, countering enemy radar and communications, and protecting friendly forces from electronic threats. The market encompasses a range of platforms, including dedicated electronic warfare aircraft, multi-role fighters with EW capabilities, and unmanned aerial systems (UAS) equipped with electronic warfare systems. As global military spending continues to rise, driven by geopolitical tensions and the increasing complexity of modern warfare, the demand for advanced EW aircraft is expected to grow significantly.

Technology Impact in Electronic Warfare Aircraft Market

Technological advancements are having a profound impact on the electronic warfare aircraft market. The development of sophisticated electronic systems, such as advanced radar, communication jamming devices, signal intelligence (SIGINT) equipment, and cyber warfare tools, is enhancing the capabilities of EW aircraft. Modern EW systems leverage artificial intelligence (AI) and machine learning (ML) to process and analyze large volumes of data in real-time, enabling faster and more accurate identification of threats. Additionally, advancements in electronic countermeasure (ECM) and electronic counter-countermeasure (ECCM) technologies are improving the ability of EW aircraft to disrupt enemy systems while protecting their own. The integration of these cutting-edge technologies into EW platforms is driving the evolution of electronic warfare strategies and tactics, making them more effective and adaptable to changing battlefield conditions.

Key Drivers in Electronic Warfare Aircraft Market

Several key drivers are fueling the growth of the global electronic warfare aircraft market. One of the primary drivers is the increasing need for advanced electronic warfare capabilities to counter evolving threats. As adversaries develop more sophisticated radar, missile systems, and communication networks, there is a growing emphasis on enhancing EW capabilities to maintain a strategic advantage. The proliferation of asymmetric warfare tactics, such as the use of unmanned systems and cyber attacks, is also driving demand for EW aircraft that can neutralize these threats. Additionally, the modernization and upgrading of existing military aircraft fleets with advanced EW systems are contributing to market growth. Many countries are investing in retrofitting older aircraft with state-of-the-art EW technology to extend their operational life and enhance their combat effectiveness.

Regional Trends in Electronic Warfare Aircraft Market

Regional trends in the electronic warfare aircraft market reflect the varying defense priorities and strategic imperatives of different countries. North America, particularly the United States, remains the largest market for EW aircraft due to its significant defense budget and ongoing investments in advanced military technologies. The U.S. Department of Defense (DoD) continues to prioritize electronic warfare capabilities as part of its overall defense strategy, leading to substantial funding for the development and procurement of EW aircraft and systems. In Europe, increasing defense spending and a renewed focus on enhancing military capabilities in response to geopolitical tensions with Russia are driving demand for EW aircraft. Countries such as the United Kingdom, France, and Germany are investing in both new EW platforms and upgrades to existing fleets to bolster their electronic warfare capabilities.

The Asia-Pacific region is also witnessing robust growth in the electronic warfare aircraft market, driven by rising defense budgets and the need to counter regional security threats. China, in particular, is making significant strides in developing its EW capabilities, with a focus on enhancing its ability to project power and counter adversaries in the region. Japan, India, and South Korea are also investing in advanced EW systems to strengthen their defense capabilities and ensure regional stability. In the Middle East, the ongoing conflict and security concerns are driving demand for EW aircraft. Countries such as Saudi Arabia, the United Arab Emirates, and Israel are prioritizing the acquisition of advanced electronic warfare systems to counter potential threats and maintain their strategic edge.

Key Electronic Warfare Market Programs

The Indian Air Force recently struck an agreement with industrial partner Bharat Electronics Limited (BEL) to supply an advanced Electronic Warfare suite for its fighter aircraft. The overall cost of the contract is estimated to be around Rs 1993 crores (approximately $26.5 million). Modern EW systems will greatly increase the battle-survivability of IAF fighter aircraft while flying operational missions against opponents' ground-based and airborne fire control and surveillance radars.After the 2019 clash between the Indian Air Force and Pakistani jets following the Balakot strikes, as well as the standoff with China in the Eastern Ladakh region, where both sides had mobilised their respective combat aircraft, the IAF's EW suite contract becomes relevant.

The first Gulfstream G550 'green' Joint Airborne MultisensorMultimission System (JAMMS) aircraft has been delivered to the Italian Air Force (AeronauticaMilitareItaliana: AMI). On March 7, the G550 JAMMS arrived at Pratica di Mare Air Base, where the 14th Air Wing flies two G550 Conformal Airborne Early Warning (CAEW) aircraft. The MMMS [multimission multisensor] aircraft will be utilised to undertake tactical operational scenario monitoring and surveillance, support strategic and operational decisions, and carry out command-and-control (C2) and electronic protection missions.

The Swedish government has decided to replace its Saab 340 airborne early warning and control (AEW&C) aircraft with the GlobalEye, which is far more modern and capable. The Swedish Air Force's potential GlobalEye and Gripen E combination. The Swedish Air Force now employs two of the four original ASC 890s (internal designation: Saab 340 AEW) equipped with an AESA Erieye side scan radar with a coverage of °300 and the capacity to detect a fighter-sized target at a distance of 250 kilometres. Although their replacement has been sought for years, the procedure has only just received government approval.

Table of Contents

Electronic Warfare Aircraft Market Report Definition

Electronic Warfare Aircraft Market Segmentation

By Platform

By Region

By EW Mode

Electronic Warfare Aircraft Market Analysis for next 10 Years

The 10-year electronic warfare aircraft market analysis would give a detailed overview of electronic warfare aircraft market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Electronic Warfare Aircraft Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Electronic Warfare Aircraft Market Forecast

The 10-year electronic warfare aircraft market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Electronic Warfare Aircraft Market Trends & Forecast

The regional electronic warfare aircraft market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Electronic Warfare Aircraft Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Electronic Warfare Aircraft Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Electronic Warfare Aircraft Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By EW Mode, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By EW Mode, 2024-2034

List of Figures

- Figure 1: Global Electronic Warfare Aircraft Market Forecast, 2024-2034

- Figure 2: Global Electronic Warfare Aircraft Market Forecast, By Region, 2024-2034

- Figure 3: Global Electronic Warfare Aircraft Market Forecast, By Platform, 2024-2034

- Figure 4: Global Electronic Warfare Aircraft Market Forecast, By EW Mode, 2024-2034

- Figure 5: North America, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 6: Europe, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 8: APAC, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 9: South America, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 10: United States, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 11: United States, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 12: Canada, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 14: Italy, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 16: France, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 17: France, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 18: Germany, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 24: Spain, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 30: Australia, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 32: India, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 33: India, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 34: China, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 35: China, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 40: Japan, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Electronic Warfare Aircraft Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Electronic Warfare Aircraft Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Electronic Warfare Aircraft Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Electronic Warfare Aircraft Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Electronic Warfare Aircraft Market, By Platform (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Electronic Warfare Aircraft Market, By Platform (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Electronic Warfare Aircraft Market, By EW Mode (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Electronic Warfare Aircraft Market, By EW Mode (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Electronic Warfare Aircraft Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Electronic Warfare Aircraft Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Electronic Warfare Aircraft Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Electronic Warfare Aircraft Market, By Region, 2024-2034

- Figure 58: Scenario 1, Electronic Warfare Aircraft Market, By Platform, 2024-2034

- Figure 59: Scenario 1, Electronic Warfare Aircraft Market, By EW Mode, 2024-2034

- Figure 60: Scenario 2, Electronic Warfare Aircraft Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Electronic Warfare Aircraft Market, By Region, 2024-2034

- Figure 62: Scenario 2, Electronic Warfare Aircraft Market, By Platform, 2024-2034

- Figure 63: Scenario 2, Electronic Warfare Aircraft Market, By EW Mode, 2024-2034

- Figure 64: Company Benchmark, Electronic Warfare Aircraft Market, 2024-2034