PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1820811

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1820811

Global Ship Radar Market 2025-2035

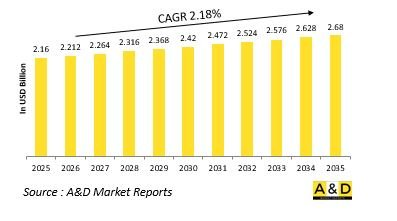

The Global Ship Radar market is estimated at USD 2.16 billion in 2025, projected to grow to USD 2.68 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 2.18% over the forecast period 2025-2035.

Introduction to Ship Radar Market:

The defense ship radar market is a critical segment of modern naval capabilities, providing essential situational awareness, threat detection, and navigation support for maritime defense operations. Shipborne radar systems serve as the primary sensors on naval vessels, enabling the detection, tracking, and classification of targets across sea, air, and surface domains. They form the foundation for mission-critical tasks such as surveillance, fire control, missile guidance, and fleet coordination, ensuring naval forces maintain strategic superiority in contested maritime environments. As global naval operations become increasingly complex and multi-dimensional, the demand for advanced radar systems capable of operating in diverse weather conditions, cluttered sea states, and electronic warfare scenarios has grown significantly. Modern naval doctrines emphasize early warning, real-time data sharing, and integrated combat systems, all of which rely heavily on the capabilities of shipborne radar. Additionally, rising emphasis on maritime domain awareness, anti-piracy operations, and protection of sea-based trade routes has further expanded the operational scope of radar systems. With evolving naval strategies and the emergence of sophisticated maritime threats, defense ship radar technology continues to evolve as a central component of naval modernization programs, ensuring effective command, control, and defense in an increasingly contested maritime landscape.

Technology Impact in Ship Radar Market:

Technological advancements are profoundly reshaping the defense ship radar landscape, significantly enhancing performance, precision, and resilience. The shift from conventional mechanically scanned arrays to active electronically scanned array technology has dramatically improved detection range, tracking speed, and target discrimination, allowing ships to identify multiple threats simultaneously with greater accuracy. Advanced signal processing algorithms and artificial intelligence integration are enabling real-time analysis of vast data streams, enhancing situational awareness and decision-making. The incorporation of digital beamforming and multi-function radar systems allows vessels to perform multiple roles - from surveillance and targeting to navigation and weather monitoring - without requiring separate hardware. Enhanced electronic counter-countermeasures are strengthening radar resilience against jamming and deception tactics, ensuring reliability even in contested electromagnetic environments. Moreover, modular and scalable radar architectures are allowing seamless integration into different classes of naval vessels, enhancing operational flexibility. The convergence of radar systems with network-centric warfare platforms and data fusion technologies further improves interoperability and coordinated response across fleets. As emerging technologies such as quantum sensing and AI-driven automation continue to mature, ship radar systems are evolving into intelligent, adaptive, and multi-mission solutions that significantly enhance naval operational capabilities and maritime security strategies.

Key Drivers in Ship Radar market:

The growth of the defense ship radar market is driven by a combination of strategic imperatives, evolving threats, and technological requirements. Increasing geopolitical tensions and the strategic importance of maritime dominance are compelling nations to invest heavily in advanced radar systems for their naval fleets. The rising complexity of modern naval threats, including stealth vessels, hypersonic weapons, and swarm drone attacks, is pushing defense forces to deploy radars with enhanced detection sensitivity and rapid response capabilities. Expanding maritime trade routes and the need to safeguard critical sea lanes are further intensifying the demand for robust maritime surveillance systems. The modernization of naval fleets and the introduction of multi-mission combat ships are creating opportunities for radar solutions that integrate seamlessly with advanced combat management systems. Additionally, growing emphasis on network-centric warfare and joint maritime operations is driving the need for interoperable radar platforms capable of real-time data sharing across fleets and allied forces. The increasing role of naval forces in humanitarian missions, anti-piracy operations, and maritime law enforcement is also broadening the operational applications of radar technologies. Together, these factors are shaping a rapidly evolving market where radar systems remain fundamental to maritime defense strategy and tactical superiority.

Regional Trends in Ship Radar Market:

Regional trends in the defense ship radar market reflect diverse strategic priorities, defense modernization goals, and evolving maritime challenges across different geographies. In North America, strong emphasis on naval superiority and technological innovation is driving extensive investments in next-generation radar systems, particularly those integrated with advanced missile defense and electronic warfare capabilities. European nations are focusing on enhancing fleet interoperability and coastal defense, investing in multi-mission radar platforms to support collaborative naval operations and joint security initiatives. The Asia-Pacific region is experiencing rapid growth, fueled by territorial disputes, expanding naval fleets, and heightened focus on securing strategic waterways. Middle Eastern countries are prioritizing maritime surveillance and coastal protection, adopting advanced radar technologies to safeguard vital shipping routes and offshore assets. In Latin America and Africa, modernization efforts are gradually expanding as nations seek to strengthen maritime patrol and counter-smuggling capabilities. Across all regions, there is a clear shift toward multifunctional radar systems, modular designs, and integration with broader command and control architectures. This global trend underscores the essential role of radar in shaping future naval strategies, enhancing maritime domain awareness, and ensuring strategic dominance in increasingly contested and complex maritime environments.

Key Defense Ship Radar Program:

Raytheon, a business unit, has received a $536 million contract from the U.S. Navy to advance the SPY-6 family of radars. This new award builds on a previous Integration and Production Support contract and includes the modernization of Flight IIA destroyers with the SPY-6(V)4 radar variant. As part of the sole-source agreement, Raytheon will continue delivering comprehensive support for the SPY-6 radar program. This includes providing training, engineering services, shipboard installation, system integration and testing, along with ongoing software enhancements designed to further strengthen the radar's capabilities and operational performance.

Table of Contents

Ship Radar Market Report Definition

Ship Radar Market Segmentation

By Type

By Region

Ship Radar Market Analysis for next 10 Years

The 10-year ship radar market analysis would give a detailed overview of ship radar market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Ship Radar Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Ship Radar Market Forecast

The 10-year ship radar market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Ship Radar Market Trends & Forecast

The regional ship radar market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Ship Radar Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Ship Radar Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Ship Radar Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Frequency, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Frequency, 2025-2035

List of Figures

- Figure 1: Global Ship Radar Market Forecast, 2025-2035

- Figure 2: Global Ship Radar Market Forecast, By Region, 2025-2035

- Figure 3: Global Ship Radar Market Forecast, By Type, 2025-2035

- Figure 4: Global Ship Radar Market Forecast, By Frequency, 2025-2035

- Figure 5: North America, Ship Radar Market, Market Forecast, 2025-2035

- Figure 6: Europe, Ship Radar Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Ship Radar Market, Market Forecast, 2025-2035

- Figure 8: APAC, Ship Radar Market, Market Forecast, 2025-2035

- Figure 9: South America, Ship Radar Market, Market Forecast, 2025-2035

- Figure 10: United States, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 11: United States, Ship Radar Market, Market Forecast, 2025-2035

- Figure 12: Canada, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Ship Radar Market, Market Forecast, 2025-2035

- Figure 14: Italy, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Ship Radar Market, Market Forecast, 2025-2035

- Figure 16: France, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 17: France, Ship Radar Market, Market Forecast, 2025-2035

- Figure 18: Germany, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Ship Radar Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Ship Radar Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Ship Radar Market, Market Forecast, 2025-2035

- Figure 24: Spain, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Ship Radar Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Ship Radar Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Ship Radar Market, Market Forecast, 2025-2035

- Figure 30: Australia, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Ship Radar Market, Market Forecast, 2025-2035

- Figure 32: India, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 33: India, Ship Radar Market, Market Forecast, 2025-2035

- Figure 34: China, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 35: China, Ship Radar Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Ship Radar Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Ship Radar Market, Market Forecast, 2025-2035

- Figure 40: Japan, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Ship Radar Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Ship Radar Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Ship Radar Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Ship Radar Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Ship Radar Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Ship Radar Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Ship Radar Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Ship Radar Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Ship Radar Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Ship Radar Market, By Frequency (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Ship Radar Market, By Frequency (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Ship Radar Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Ship Radar Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Ship Radar Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Ship Radar Market, By Region, 2025-2035

- Figure 58: Scenario 1, Ship Radar Market, By Type, 2025-2035

- Figure 59: Scenario 1, Ship Radar Market, By Frequency, 2025-2035

- Figure 60: Scenario 2, Ship Radar Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Ship Radar Market, By Region, 2025-2035

- Figure 62: Scenario 2, Ship Radar Market, By Type, 2025-2035

- Figure 63: Scenario 2, Ship Radar Market, By Frequency, 2025-2035

- Figure 64: Company Benchmark, Ship Radar Market, 2025-2035