PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1706586

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1706586

Global Aircraft LRU Market 2025-2035

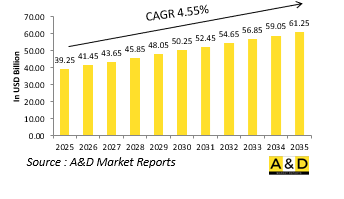

The Global Aircraft LRU market is estimated at USD 39.25 billion in 2025, projected to grow to USD 61.25 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 4.55% over the forecast period 2025-2035.

Introduction to Aircraft LRU Market:

Line Replaceable Units (LRUs) are modular components that can be quickly replaced at the operational level to maintain aircraft availability and reduce downtime. In military aviation, LRUs are a cornerstone of maintainability and readiness, allowing flight crews and maintenance teams to swap out faulty subsystems-ranging from radar modules and avionics boxes to hydraulic actuators and communication devices-without requiring extensive disassembly or depot-level support. LRUs are essential to the operational efficiency of military aircraft, which must remain combat-ready in often austere and unpredictable environments. Their use supports the "two-level maintenance" concept-organizational and depot level-by allowing organizational units to perform rapid repairs and replacements on-site. This capability significantly increases sortie generation rates and minimizes mission interruptions. As military aircraft platforms become more advanced and system-integrated, the reliance on LRU-based design has grown. Not only do they simplify maintenance logistics, but LRUs also standardize components across multiple aircraft types, helping militaries reduce inventory overhead, streamline training, and facilitate faster upgrades. In modern fighter jets, transport aircraft, helicopters, and unmanned systems, LRUs are the hidden enablers of sustainability, lifecycle cost management, and combat readiness.

Technology Impact in Aircraft LRU Market:

Advancements in technology are dramatically reshaping the form, function, and performance of military aircraft LRUs. Modern LRUs are no longer just replaceable "black boxes"; they are becoming smarter, lighter, and more integrated, aligning with trends in avionics, digitalization, and modular system architecture. Miniaturization and increased processing power allow more functionality to be packed into a smaller footprint. This is crucial for modern military aircraft, where space and weight are at a premium. Today's LRUs often contain advanced microprocessors, fault-tolerant circuitry, and integrated diagnostics systems, allowing them to monitor their own health and predict failures before they occur-an essential element of predictive maintenance.

Modular Open Systems Architecture (MOSA) is having a significant impact as well. Many militaries, particularly the U.S. Department of Defense, are pushing for open standards in avionics and electronics. This shift means LRUs are being designed with interoperability and future upgradeability in mind. Standardized interfaces, like VITA standards or OpenVPX, allow for plug-and-play capabilities across multiple platforms and vendors, drastically reducing system lifecycle costs and simplifying logistics chains. Cybersecurity has become another major area of focus. Since LRUs often handle critical flight, targeting, or communication data, ensuring that they are secure from cyber threats is paramount. This has led to the integration of embedded encryption, secure boot mechanisms, and authentication protocols within LRU firmware and hardware. Technologies like Trusted Platform Modules (TPMs) and intrusion detection sensors are increasingly becoming standard in mission-critical LRUs.

Further, digital twin and augmented reality (AR) tools are beginning to be used alongside LRUs. These technologies provide technicians with virtual overlays for guided maintenance and simulate LRU behaviors in virtual environments, enhancing training and operational planning. Integration with logistics systems and digital maintenance records also allows for seamless asset tracking and configuration control.

Key Drivers in Aircraft LRU Market:

The growth and evolution of the global military aircraft LRU market are driven by a combination of operational, logistical, and strategic factors. One of the primary drivers is the increased complexity of military aircraft systems. Fifth-generation fighter jets, stealth bombers, and multi-role transport aircraft now rely on thousands of interconnected electronic and mechanical components. Without modular LRUs, maintaining such platforms would be slow, inefficient, and prohibitively expensive. Operational readiness requirements are another powerful driver. Military forces worldwide prioritize high availability and mission-capable rates for their aircraft fleets. LRUs enable quick turnaround times between missions, reducing aircraft downtime during forward deployments or high-tempo operations. For expeditionary forces or carrier-based air wings, this is especially vital. The emphasis on fleet lifecycle cost management is also promoting greater use of LRUs. Militaries are under increasing budgetary scrutiny and must extend the operational life of aging platforms while integrating new technologies. LRUs facilitate incremental upgrades without needing to replace entire systems. For instance, a legacy radar processor in a reconnaissance aircraft can be replaced with a newer, more capable unit while maintaining the original radar array and interface.

Another key driver is interoperability and joint force integration. As multinational military coalitions become more common, having standardized, easily replaceable components helps maintain compatibility across allied forces. Shared LRU platforms and open architectures enable allied nations to support each other logistically during joint missions or peacekeeping operations. In addition, supply chain resilience and local manufacturing goals are encouraging countries to invest in domestic LRU production capabilities. This reduces reliance on foreign suppliers, enables rapid customization, and allows defense contractors to respond more flexibly to changing mission needs. Many nations are incorporating LRU development into broader defense industrial strategies to build self-reliance and indigenous innovation.

Regional Trends in Aircraft LRU Market:

Regional trends in the military aircraft LRU market reflect each region's strategic posture, procurement philosophy, and domestic industrial base. In North America, particularly the United States, the military LRU market is highly mature and technology-driven. Programs such as the F-35 Lightning II, B-21 Raider, and Next Generation Air Dominance (NGAD) all heavily rely on LRU-centric design to facilitate rapid component replacement and system upgrades. The U.S. military's push toward modular open systems and digital engineering is setting the global standard, with LRUs designed for longevity and rapid integration of next-gen capabilities like AI, EW, and quantum communications.

Europe is experiencing a strong push toward joint platform development and LRU standardization, especially under programs like the Future Combat Air System (FCAS) involving France, Germany, and Spain. European nations are increasingly adopting a modular approach to aircraft systems to foster collaboration and maintain independence from U.S. suppliers. Airbus, Leonardo, and Thales are leading efforts to develop LRU systems aligned with open standards and tailored for NATO interoperability. In the Asia-Pacific region, rising geopolitical tensions and a push for indigenous defense production are fueling LRU development. Countries like China, India, South Korea, and Japan are expanding their military aviation capabilities with both imported and domestic platforms. China's J-20 and India's Tejas fighters use LRU frameworks that enable scalable upgrades and maintenance. The region is also witnessing the emergence of local LRU suppliers capable of producing navigation, fire control, and mission management systems.

Key Aircraft LRU Program:

The Directorate of Engineering B (Technical), Air Headquarters (Vayu Bhawan), on behalf of the Ministry of Defence, Government of India, invites Expressions of Interest (EoI) from reputable Indian firms for the procurement of four categories of Line Replaceable Units (LRUs) for the KIRAN MK-I/IA fleet of the Indian Air Force. Eligible firms must be based in India and possess the necessary technical expertise, financial capability, infrastructure, and relevant experience to undertake the project. The scope of work includes obtaining airworthiness certification where applicable and ensuring delivery within defined timelines.

Table of Contents

Aircraft LRU Market Report Definition

Aircraft LRU Market Segmentation

By Platform

By Region

By Type

Aircraft LRU Market Analysis for next 10 Years

The 10-year aircraft LRU market analysis would give a detailed overview of aircraft LRU market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Aircraft LRU Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Aircraft LRU Market Forecast

The 10-year aircraft LRU market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Aircraft LRU Market Trends & Forecast

The regional aircraft LRU market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Aircraft LRU Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Aircraft LRU Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Aircraft LRU Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Aircraft LRU Market Forecast, 2025-2035

- Figure 2: Global Aircraft LRU Market Forecast, By Region, 2025-2035

- Figure 3: Global Aircraft LRU Market Forecast, By Platform, 2025-2035

- Figure 4: Global Aircraft LRU Market Forecast, By Type, 2025-2035

- Figure 5: North America, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 6: Europe, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 8: APAC, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 9: South America, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 10: United States, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 11: United States, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 12: Canada, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 14: Italy, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 16: France, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 17: France, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 18: Germany, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 24: Spain, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 30: Australia, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 32: India, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 33: India, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 34: China, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 35: China, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 40: Japan, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Aircraft LRU Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Aircraft LRU Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Aircraft LRU Market, By Platform (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Aircraft LRU Market, By Platform (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Aircraft LRU Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Aircraft LRU Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Aircraft LRU Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Aircraft LRU Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Aircraft LRU Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Aircraft LRU Market, By Region, 2025-2035

- Figure 58: Scenario 1, Aircraft LRU Market, By Platform, 2025-2035

- Figure 59: Scenario 1, Aircraft LRU Market, By Type, 2025-2035

- Figure 60: Scenario 2, Aircraft LRU Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Aircraft LRU Market, By Region, 2025-2035

- Figure 62: Scenario 2, Aircraft LRU Market, By Platform, 2025-2035

- Figure 63: Scenario 2, Aircraft LRU Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Aircraft LRU Market, 2025-2035