PUBLISHER: Global Insight Services | PRODUCT CODE: 1585848

PUBLISHER: Global Insight Services | PRODUCT CODE: 1585848

Global OEM Electrolyzer Projects Database

"Global OEM Electrolyzer Projects Database" is a new subscription offering from Global Insight Services that offers tracking of new hydrogen electrolyzer projects. Subscribers to this service receive access to updates to projects database on a monthly basis.

INFOGRAPHICS

An electrolyzer is a device that uses electricity to drive a non-spontaneous chemical reaction, typically the electrolysis of water into hydrogen and oxygen. In this process, an electric current is passed through water, causing it to decompose into its constituent elements: hydrogen gas (H2) at one electrode and oxygen gas (O2) at the other electrode. Electrolyzers play a key role in the production of hydrogen for various industrial applications, energy storage, and as a clean fuel source for vehicles.

Given the rapidly changing and evolving nature of project landscape, Global OEM Electrolyzer Projects Database is an essential source of market information for participants across the hydrogen value chain.

Covering 300+ manufacturing facilities, this database delivers detailed data on electrolyzer capacity, production volumes, technology, funding details, participants, project status, and timelines for efficient hydrogen project planning and analysis across industries, aiding clients in tracking manufacturing progress from inception to completion for informed decision-making.

- Comprehensive Manufacturer Coverage: Detailed profiles of leading OEMs across regions and technologies

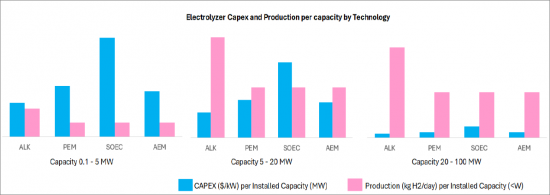

- Performance Metrics: In-depth data on capacity, efficiency, Capex and project costs

- Project Tracking: Data on ongoing and planned Electrolyzer projects globally

- Competitive Benchmarking: Comparisons across OEMs for technology, price, and production capacity

- Technology Advancements: Tracks emerging technologies, such as PEM, Alkaline, and Solid Oxide, to identify trends and innovations

- Geographic Analysis: Regional breakdowns, enabling clients to target specific markets based on hydrogen adoption trends.

- Partnership and Collaboration Data: Information on strategic alliances and joint ventures between OEMs and other stakeholders.

- Financing and Incentives: Information on government subsidies, incentives, and financing options for Electrolyzer projects.

Database Coverage:

| Projects | 250+ |

| Region | Global |

| Electrolyzer Manufacturers | 100+ |

| Project Information | Project name, Project location, Project category, Project participants, Plant status, Funding provider, Funding value, Project cost, Type of renewable energy, Electrolyzer manufacturer, Technology, Electrolyzer Capacity, Hydrogen Production Capacity, Hydrogen End-Users, Supply Source Asset Capacity, Project Announcement Year, Project Construction Start Year, Project Construction End Year |

| Electrolyzer Technology | Alkaline Water Electrolysis, Proton Exchange Membrane, Solid Oxide Electrolysis Cell, Anion Exchange Membrane, Capillary-fed Electrolysis and Membrane-Free Electrolysis |

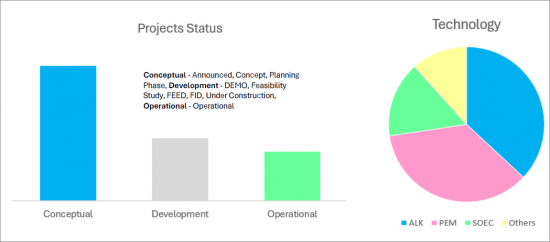

| Project Status | Under Construction, Announced, Operational, Planning Phase, Concept, FID, Feasibility Study, DEMO, FEED |

| Hydrogen End-Users | Ammonia, Cement, Chemicals, E-commerce, e-fuels, Electric Vehicles, Energy, Energy Storage, Fertilizer Production, Food Value Chain, Fuel Cells, Heating, Hydrogen Fuelling System, Logistics, Manufacturing, Methanol, Mobility, Refineries, Steel, Synfuels, Telecommunications |

| Key Hydrogen Companies | H2 Energy, orsted, ENGIE, BP, Infinite Green Energy Ltd, Fortescue Future Industries, ScottishPower |

| Key Electrolyzer Manufacturers | Nel ASA, Siemens, McPhy Energy, ITM Power Plc, Gaztransport & Technigaz (Elogen), Green Hydrogen Systems, iGas Energy GmbH, Next Hydrogen, Asahi Kasei, thyssenkrupp, Cummins (Hydrogenics), Toshiba Corporation, Plug Power, John Cockerill, Enagas (H2Greem), Sunfire GmbH, Bloom Energy, Air Liquide, Volkswagen AG (H-TEC SYSTEMS), Enapter AG |

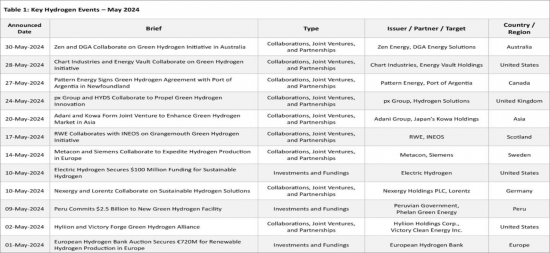

Monthly Newsletter

Subscribers to the service also receive a monthly newsletter summarizing key developments in the sector by:

- Project Announcements & Approvals

- Investments and Fundings

- Collaborations, Joint Ventures, and Partnerships

- Hydrogen Policy

- Electrolyzer Manufacturing

Analyst Insights on India OEM Electrolyzers Database

As of October 2024, the "OEM Electrolyzer Projects Database 2024" records around 41 hydrogen electrolyzer projects in India. The status of these projects is a mixed but promising landscape:

- Operational Projects: Approximately 15% of these facilities are active, producing hydrogen and setting the benchmark for commercial and industrial applications.

- New Announcements: In 2024 alone, 11 new projects were announced, collectively exceeding a capacity of 6,600 MW. This influx of projects highlights the accelerated pace of development and investment in the sector.

Major participants in these projects include Sterling and Wilson Private Limited, Tecnicas Reunidas, S.A., HET Hydrogen (a subsidiary of Horizon Fuel Cell Technologies), and the Avaada Group, each of which has announced two significant projects in 2024. Approximately 55% of the hydrogen produced from these electrolyzers is dedicated to energy sector applications, while 36% is earmarked for industrial use, emphasizing the diverse potential of hydrogen across different sectors.

The technological distribution in India's hydrogen electrolyzer market is currently led by Alkaline technology, which accounts for 32% of projects. Proton Exchange Membrane (PEM) technology follows closely at 24.4%, and Solid Oxide Electrolyzer Cell (SOEC) technology, while still in its nascent stage, makes up 7.3% of the market.

The "Hydrogen Electrolyzer Market Report 2024-2033" reveals that:

- Alkaline Electrolyzers: Valued at $11.1 million in 2023, this segment is expected to grow at a CAGR of 33.3% from 2024 to 2033.

- PEM Electrolyzers: With a higher revenue growth potential, this segment is forecasted to grow at a CAGR of 38.2% over the same period, reaching $224.9 million by 2033.

Regional Leaders: The states of Gujarat and Karnataka dominate India's hydrogen electrolyzer landscape, reflecting regional strategic priorities and energy resource availability:

- Gujarat: With 27% of documented projects, Gujarat is a critical hub for hydrogen production, supported by an installed capacity of approximately 1,500 MW.

- Karnataka: This state leads in total capacity, with over 12,500 MW of electrolyzers, 83% of which are based on PEM technology. Notable among these is a significant SOEC technology project, jointly developed by Ceres Power and Shell. Announced in 2022 and supported with $100 million in funding from Ceres Power, construction commenced in 2024, with operations expected by 2026.

The combined electrolyzer capacity from all projects in India exceeds 35,000 MW, a testament to the country's aggressive push to scale hydrogen production and support decarbonization.